During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting Analyst Stock Ratings page. Traders can sort through Benzinga’s extensive database of analyst ratings, including by analyst accuracy.

Below are the ratings of the most accurate analysts for three high-yielding stocks in the real estate sector.

Brandywine Realty Trust BDN

- Dividend Yield: 11.30%

- Truist Securities analyst Michael Lewis maintained a Buy rating and cut the price target from $7 to $6 on Feb. 13, 2024. This analyst has an accuracy rate of 68%.

- Deutsche Bank analyst Omotayo Okusanya initiated coverage on the stock with a Hold rating and a price target of $5.5 on Jan. 30, 2024. This analyst has an accuracy rate of 62%.

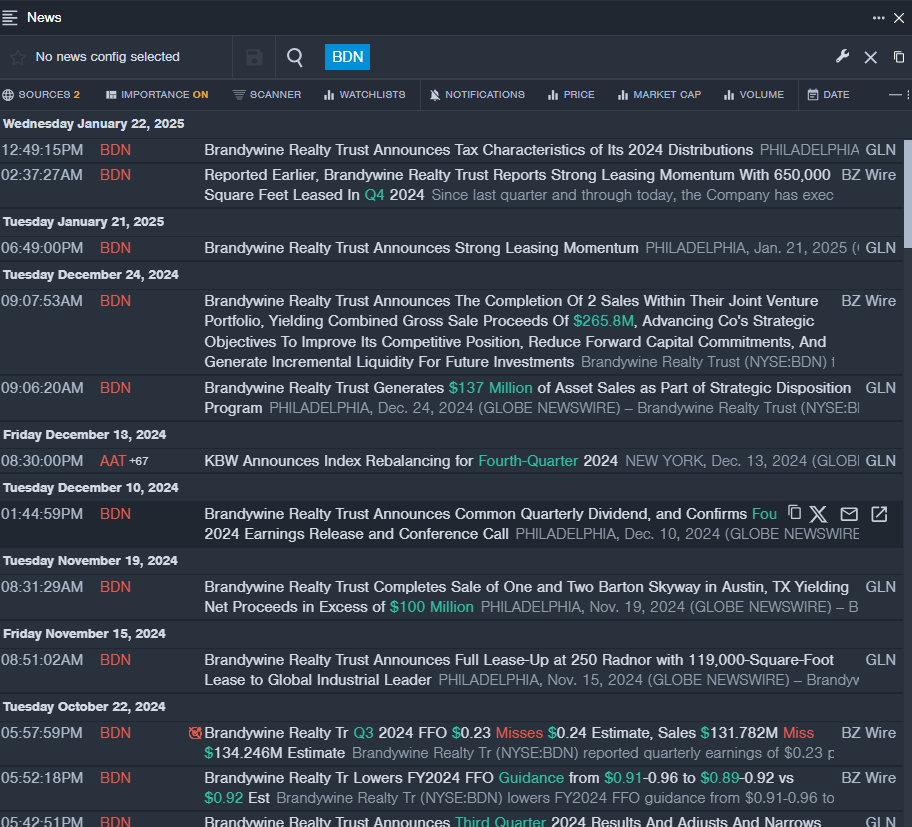

- Recent News: On Dec. 10, 2024, Brandywine Realty Trust declared a quarterly cash dividend of 15 cents per common share and OP Unit payable on Jan. 23, 2025 to holders of record on Jan. 8, 2025.

- Benzinga Pro’s real-time newsfeed alerted to latest BDN news.

EPR Properties EPR

- Dividend Yield: 7.36%

- JP Morgan analyst Anthony Paolone maintained an Overweight rating and increased the price target from $48 to $51 on Sept. 9, 2024. This analyst has an accuracy rate of 64%.

- Truist Securities analyst Ki Bin Kim maintained a Hold rating and raised the price target from $44 to $46 on Aug. 16, 2024. This analyst has an accuracy rate of 67%.

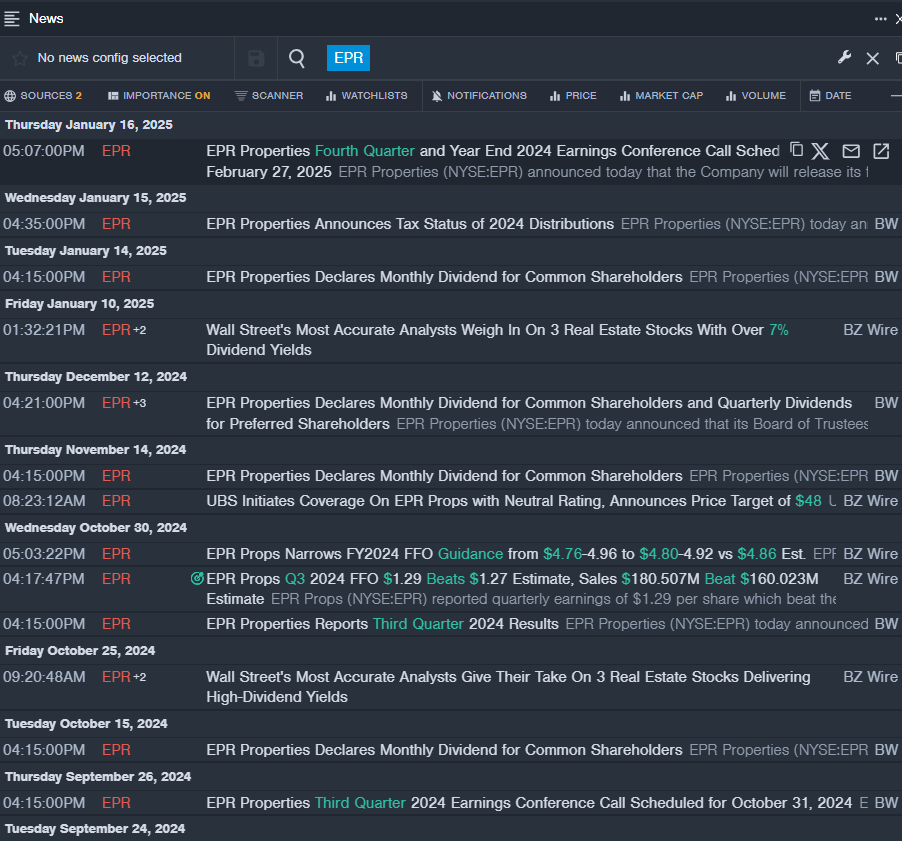

- Recent News: EPR Properties will release its fourth quarter 2024 financial results after the closing bell on Wednesday, Feb. 26.

- Benzinga Pro’s real-time newsfeed alerted to latest EPR news.

Park Hotels & Resorts Inc. PK

- Dividend Yield: 10.16%

- UBS analyst Robin Farley maintained a Neutral rating and raised the price target from $14 to $15 on Nov. 18, 2024. This analyst has an accuracy rate of 80%.

- Truist Securities analyst Patrick Scholes maintained a Buy rating and cut the price target from $20 to $18 on Sept. 4, 2024. This analyst has an accuracy rate of 71%.

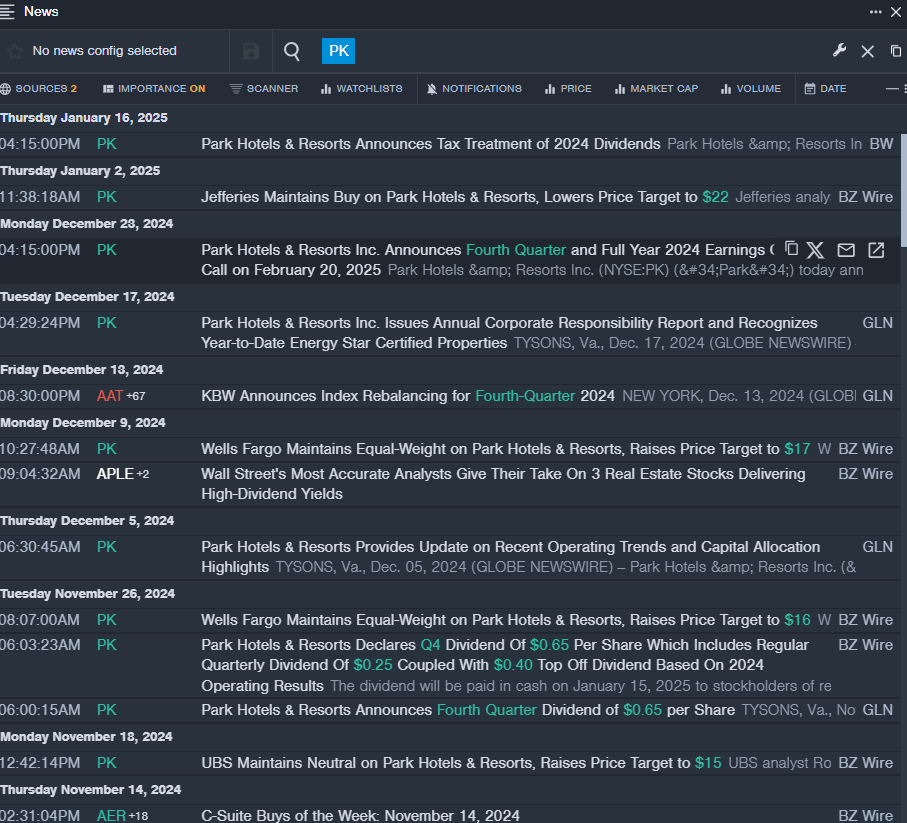

- Recent News: Park Hotels & Resorts will report financial results for the fourth quarter and full year 2024 after the closing bell on Wednesday, Feb. 19.

- Benzinga Pro’s real-time newsfeed alerted to latest PK news.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.