Ford Motor Co. F has indicated that it may hike vehicle prices amid uncertainty about the Donald Trump administration’s tariffs on the auto industry.

What Happened: In a memo sent to dealers across the country on Wednesday, the Michigan-based auto giant said it may raise prices of its vehicles should auto tariffs continue to be in place, according to a Reuters report.

While there could be a potential price hike in Ford products, the customers won’t see its reflection in the dealerships until July, according to the report.

“Customers will have a lot of choices, and we have plenty of inventory to choose from through June 2. The tariff situation is dynamic, and we continue to evaluate the potential impact of tariff actions,” a Ford spokesperson cited in the report said.

Why It Matters: The company had recently launched its ‘From America, For America’ discount program, which will run through June 2.

The program extends discounts on Ford and Lincoln vehicles — usually reserved for company employees — to all U.S.-based consumers. It’s worth noting that the program does not include the company’s Raptor models, 2025 Expedition and Navigator SUVs, and Super Duty trucks.

Michigan-based auto companies have been bearing the brunt of Trump’s auto tariffs, with a recent report suggesting Ford is at a high risk of a negative rating by ratings agency S&P.

However, in what could be some much-needed relief for auto companies, Donald Trump announced he was willing to explore ways to provide some U.S. manufacturers with exemptions to the auto tariffs.

Price Action: Ford is currently trading for $9.41 on the NYSE, according to Benzinga Pro data.

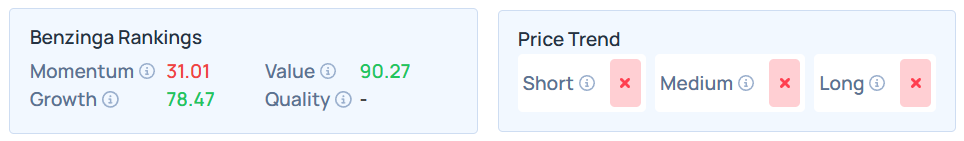

Based on Benzinga’s Edge Stock Rankings, Ford scores a solid 78.47% in growth and 90.27% in value, though it lags in momentum. Curious how other automakers stack up? Check out Benzinga Edge for deeper insights.

Check out more of Benzinga’s Future Of Mobility coverage by following this link

Read Next:

Photo courtesy: Tada Images / Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.