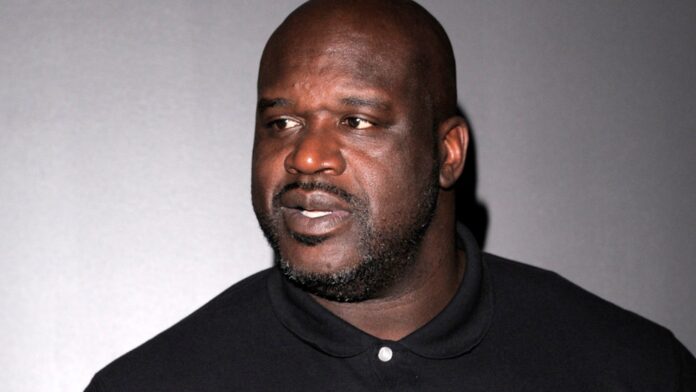

Basketball legend Shaquille O’Neal, often known as Shaq, settled a lawsuit with FTX FTT/USD customers on Tuesday over a commercial promoting the now-defunct cryptocurrency exchange.

What Happened: O’Neal and the plaintiffs have agreed upon an “amicable proposed resolution,” The Block reported, citing court documents filed in the U.S. District Court for the Southern District of Florida. The terms of the settlement will remain confidential until a motion for preliminary approval is submitted.

The lawsuit was filed in late 2022 by Edwin Garrison, an Oklahoma resident who alleged that he bought an unregistered security from FTX after seeing the company’s advertisements. Shaq was featured in one of them, where the NBA superstar said he was excited about partnering with FTX.

Shaq clarified his position, stating that he was merely a paid spokesperson and had no involvement with the company’s operations. Court disclosures showed that FTX paid nearly $750,000 to Shaq as part of its marketing efforts.

FTX came crashing down following accusations of misappropriation of customer accounts by his top executives, including Sam Bankman-Fried

See Also: XRP Bullish Bets In Derivatives Market Surge As CME Group Announces Futures Offering

Why It Matters: The FTX settlement follows a series of legal issues for Shaq. In November 2024, he agreed to pay $11 million in a settlement related to his promotion of the Astrals non-fungible token project after a year-long legal battle.

The plaintiffs alleged that despite being aware of potential regulatory concerns about selling unregistered securities, O’Neal promoted them to grow his cryptocurrency business.

Read Next:

Photo Courtesy: Ron Adar on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.