Power Nickel Inc. [TSX: PNPN] [OTC: PNPNF] today released exciting results from its summer 2024 drilling campaign at the Lion Zone polymetallic discovery. These results, especially from holes 63, 66, and 67, are significant for both traders and investors, even if you’re not familiar with the mining industry. Let’s break it down in simple terms.

What Are These Results?

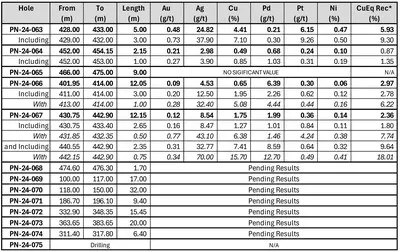

In mining, drilling campaigns are used to explore underground mineral deposits. The latest results show that Power Nickel has found high concentrations of valuable metals like copper, platinum, palladium, and nickel in three key drill holes—63, 66, and 67. The results include some very rich sections, such as:

- Hole 63: Delivered 5 meters with a copper equivalent (CuEq) grade of 5.93%.

- Hole 66: Delivered 12 meters with a CuEq grade of 2.97%.

- Hole 67: Delivered 12 meters with a CuEq grade of 2.36%.

Good morning from London! 🌍 Excited to share assay results with CuEq ranging from 2.36% to nearly 6% – and these are just from the halo outside the core Lion Zone. Core zone assays coming soon.

— Terry Lynch (@terrybali) October 1, 2024

Stay tuned for more updates from Power Nickel (TSXV: $PNPN) (OTCBB: $PNPNF )! pic.twitter.com/wWnlrOse2k

What is CuEq?

CuEq stands for “Copper Equivalent” and it combines the value of all the metals found in the sample (gold, silver, platinum, etc.) into a single copper-grade percentage. It simplifies the results so investors can understand the value in terms of a primary metal—copper, in this case.

Why Should Traders and Investors Care?

The grades reported here are considered very strong, especially the 5.93% CuEq in hole 63, which indicates a high concentration of valuable metals in that area. For comparison, typical copper mines may operate profitably with grades as low as 0.5% to 1%. This means Power Nickel could have a very valuable asset on its hands.

The increase in market cap—from $100M to $150M in just 27 days—is another indicator that the market is recognizing the potential value of this discovery. If these types of high-grade results continue, the company’s stock could see more positive movement, making it an attractive opportunity for traders and investors.

What’s Next?

Power Nickel’s drilling campaign is ongoing, and more assay results are expected soon. These new results could further validate the size and richness of the Lion Zone deposit. The company is also exploring whether this mineralized zone could extend beyond what they’ve already discovered, which could lead to even more significant finds.

Bottom Line

For investors and traders, these results suggest Power Nickel is in the early stages of proving a highly valuable mineral deposit. The potential for further gains is there, especially as more results come in and the full scale of the deposit becomes clear. Keep an eye on upcoming announcements as they could provide key opportunities for those interested in mining stocks.

Disclaimer

InvestingToday.co is a financial information website that provides news, analysis, and marketing services related to publicly traded companies. By using this website, you agree to the terms and conditions outlined in this Disclaimer.

Disclosure in Accordance with Toronto Stock Exchange Rules

This publication has been compensated by Power Nickel and other companies to disseminate information. We adhere to the disclosure rules set forth by the Toronto Stock Exchange (TSX) and other regulatory bodies, ensuring that all compensated content is clearly labeled and disclosed to our readers.

Forward-Looking Statements

This website includes forward-looking statements about future anticipated plans, performance, and development of the companies we cover. Any statements on this website that are not statements of historical fact should be considered forward-looking statements. These statements generally can be identified by words such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” “intends,” and similar expressions. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements.

Educational and Informational Purposes Only; Not Investment Advice

All content on InvestingToday.co, including articles, posts, newsletters, and comments, is provided for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or relied upon as personalized investment advice. InvestingToday.co recommends you consult a licensed or registered professional before making any investment decision, as investments can be fully lost at any time.

No Guarantees

InvestingToday.co offers no guarantees and provides forward-looking statements with the sole purpose of personal enjoyment and entertainment. If at any time a security discussed on InvestingToday.co is purchased, you agree to hold InvestingToday.co harmless and liability-free. There are no guarantees in participating in financial markets, and investments can be lost entirely at any time.

No Investment Advisor or Registered Broker

Neither InvestingToday.co nor any of its owners or employees are registered as a securities broker-dealer, investment advisor (IA), or IA representative with any securities regulatory authority. InvestingToday.co does not give out investment advice, and all content is intended solely for informational and educational purposes.

Risks and Warnings

The content published on this website is intended for reference purposes only and is neither an offer nor a solicitation to purchase or sell any security or instrument or to participate in any particular trading strategy. Users of this website agree that they are not using any content of this website in connection with an investment decision. Persons should consult with their financial advisors before making any investment decisions.

OTC Risk Warnings:

Because many securities traded Over-The-Counter (OTC) are relatively illiquid, an investment in an OTC security involves a high degree of risk. It should be noted that the liquidation of a position in an OTC security may not be possible within a reasonable period of time. Dependable information regarding issuers of OTC securities may not be available, making it difficult to properly value an investment.

Consent

By using this website and its services, or by providing us with information about yourself, you consent to the collection, storage, and use of this information. If you do not agree to these terms, please exit the website now.

Safe Harbor Statement

Forward-looking statements on this website are subject to risks and uncertainties that could cause actual results to differ materially. The Publisher does not guarantee the accuracy of any forward-looking statements and assumes no responsibility for any such statements.

Compensation Disclosure

Power Nickel has engaged InvestingToday.co for an Investor Awareness and Marketing Service Agreement through the balance of 2024. We are compensated $150,000 USD to create content for use in social media campaigns and actively support the company’s messages in financial forums across the Internet. The full press release regarding this engagement can be found here.

From time to time, InvestingToday.co provides information about publicly traded companies that have retained our services for advertising, branding, marketing, analytics, and news distribution. Compensation may create an actual or potential conflict of interest, which should be considered by all readers. Please be aware that we may buy or sell securities of the companies mentioned on this website at any time, creating a potential conflict of interest.