KeyCorp KEY will release earnings results for the first quarter, before the opening bell on Thursday, April 17.

Analysts expect the Cleveland, Ohio-based company to report quarterly earnings at 32 cents per share, up from 20 cents per share in the year-ago period. KeyCorp projects to report quarterly revenue at $1.75 billion, compared to $1.53 billion a year earlier, according to data from Benzinga Pro.

On March 13, KeyCorp plans purchase up to $1.0 billion of common shares in open market or in privately negotiated transactions.

KeyCorp shares fell 1.3% to close at $14.07 on Wednesday.

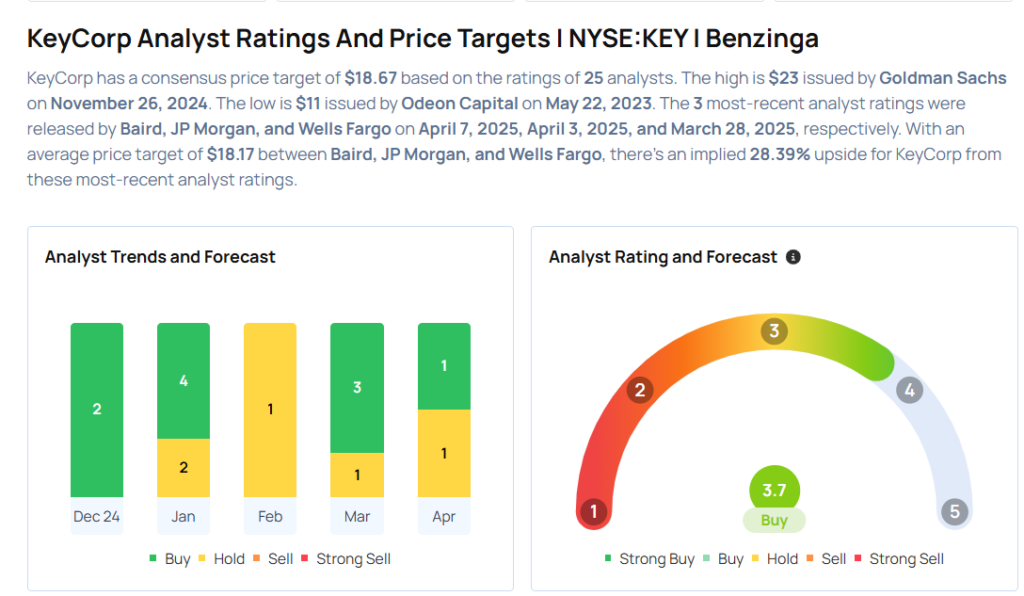

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- Baird analyst David George upgraded the stock from Neutral to Outperform with a price target of $18 on April 7, 2025. This analyst has an accuracy rate of 71%.

- Wells Fargo analyst Mike Mayo maintained an Overweight rating and slashed the price target from $22 to $20 on March 28, 2025. This analyst has an accuracy rate of 66%.

- Citigroup analyst Keith Horowitz maintained a Buy rating and slashed the price target from $20 to $19 on March 24, 2025. This analyst has an accuracy rate of 74%.

- Morgan Stanley analyst Manan Gosalia maintained an Equal-Weight rating and cut the price target from $22 to $20 on March 13, 2025. This analyst has an accuracy rate of 74%.

- RBC Capital analyst Gerard Cassidy reiterated an Outperform rating with a price target of $18 on Jan. 22, 2025. This analyst has an accuracy rate of 69%.

Considering buying KEY stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.