Emerson Electric Co. EMR will release earnings results for its fourth quarter, before the opening bell on Tuesday, Nov. 5.

Analysts expect the Saint Louis, Missouri-based company to report quarterly earnings at $1.47 per share, up from $1.29 per share in the year-ago period. Emerson Electric projects to report revenue of $4.57 billion for the quarter, compared to $4.09 billion a year earlier, according to data from Benzinga Pro.

On Aug. 21, Emerson announced it has made a strategic investment through its corporate venture capital arm Emerson Ventures in Symmera.

Emerson Electric shares gained 1.2% to close at $109.81 on Monday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

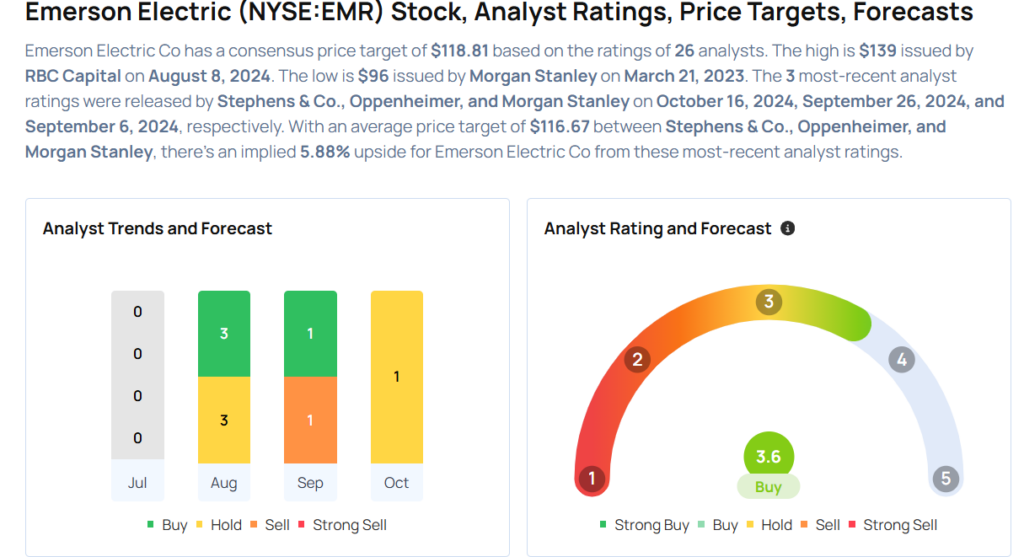

- Stephens & Co. analyst Tommy Moll downgraded the stock from Overweight to Equal-Weight and cut the price target from $135 to $120 on Oct. 16. This analyst has an accuracy rate of 80%.

- Oppenheimer analyst Christopher Glynn maintained an Outperform rating and increased the price target from $120 to $125 on Sept. 26. This analyst has an accuracy rate of 83%.

- Morgan Stanley analyst Chris Snyder initiated coverage on the stock with an Underweight rating and a price target of $105 on Sept. 6. This analyst has an accuracy rate of 74%.

- JP Morgan analyst Stephen Tusa downgraded the stock from Overweight to Neutral and slashed the price target from $132 to $115 on Aug. 14. This analyst has an accuracy rate of 69%.

- RBC Capital analyst Deane Dray maintained an Outperform rating and lowered the price target from $140 to $139 on Aug. 8. This analyst has an accuracy rate of 74%.

Considering buying EMR stock? Here’s what analysts think:

Read This Next:

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.