U.S. Pharmaceutical giant Eli Lilly And Co LLY is riding high on the popularity of weight loss drugs and is on the brink of becoming the world’s first trillion-dollar pharmaceutical company.

According to data from Benzinga Pro, the company’s market cap stood at $796.4 billion, and its enterprise value at $821.9 billion.

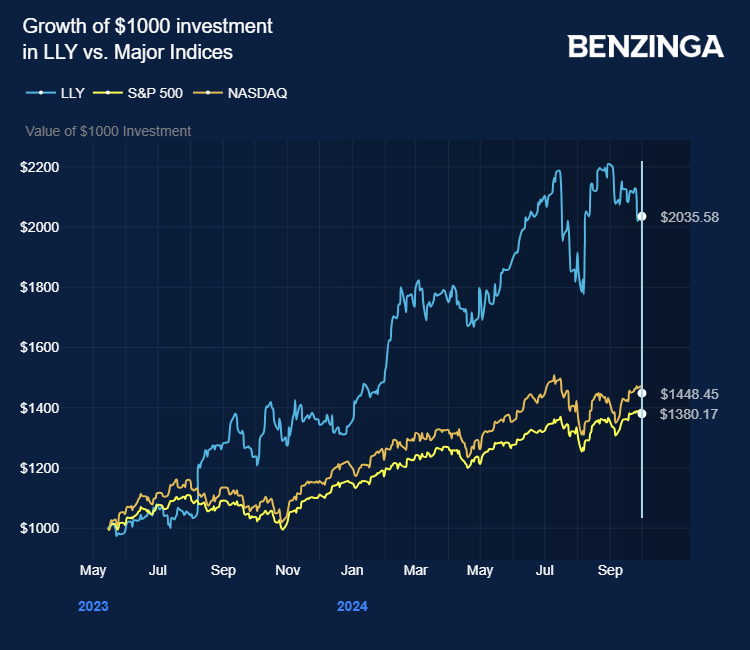

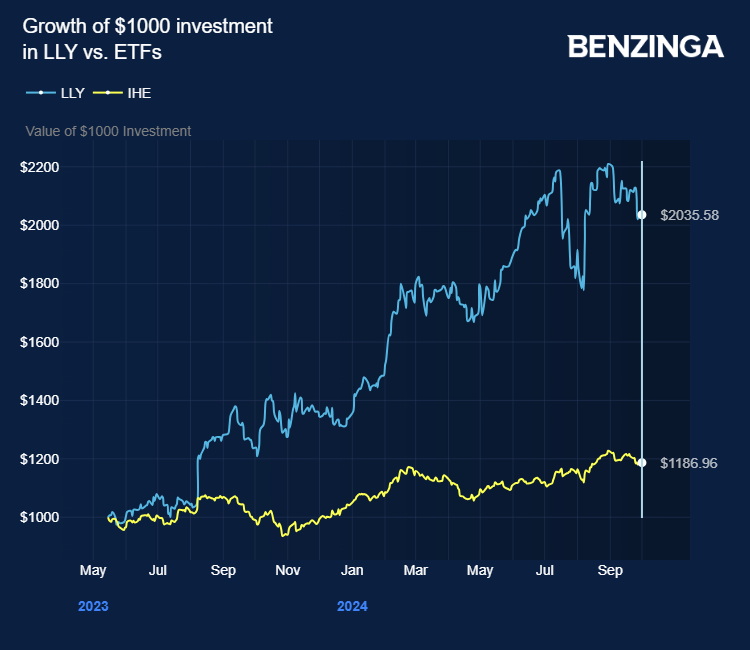

The stock had almost doubled since May 2022 and outpaced S&P500 and NASDAQ when the company received FDA approval for Mounjaro (tirzepatide) as an adjunct to diet and exercise for type 2 diabetes.

In November, the FDA approved tirzepatide, dubbed Zepbound, for weight loss.

In a Financial Times report, CEO Dave Ricks recalls a time when Eli Lilly was struggling. In the late 2000s, the loss of patents on its psychiatric drugs, including Prozac and Cymbalta, pushed the company near all-time lows.

Also Read: Eli Lilly Eyes New Trials For Weight-Loss Drugs In Non-Obese Patients.

However, the company’s fortunes have since reversed, with Eli Lilly now investing $20 billion in production facilities to meet the growing demand for its blockbuster drugs, and it is trying to stay ahead of its close competitor Novo Nordisk A/S NVO.

The company is also developing orforglipron, which could be the first small-molecule weight-loss pill when it launches in 2026, giving Eli Lilly a two-year lead before rivals catch up.

However, investors are cautious, noting that Eli Lilly’s valuation is lofty, currently at $842 billion, 54x projected earnings over the next 12 months.

A top-10 shareholder of Eli Lilly told the Financial Times that investors are rushing into Eli Lilly, pushing it higher, but it’s already priced for perfection. The shareholder warned that investors could face significant risks if concerns arise about competition from the ten other companies with weight-loss drugs or potential pricing pressures.

The company aims to strengthen its standing as one of the top 10 most valuable firms in the U.S. by outpacing its competitors.

Eli Lilly plans to reinvest its revenues into R&D, aiming to escape the pharmaceutical industry’s traditional boom-and-bust cycle.

CEO Ricks says the company is preparing for the future, particularly as it nears a “patent cliff” for its weight-loss drugs in the mid-2030s. By then, competition and pricing pressure could significantly affect profits.

The company is working on new treatments for obesity-related conditions, such as sleep apnea and cardiovascular disease, which could secure broader insurance coverage for its drugs.

Price Action: LLY stock closed at $884.55 on Tuesday.

Read Next:

Photo via Eli Lilly and Company

This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.