In the preceding three months, 15 analysts have released ratings for Micron Technology MU, presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 8 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 3 | 7 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

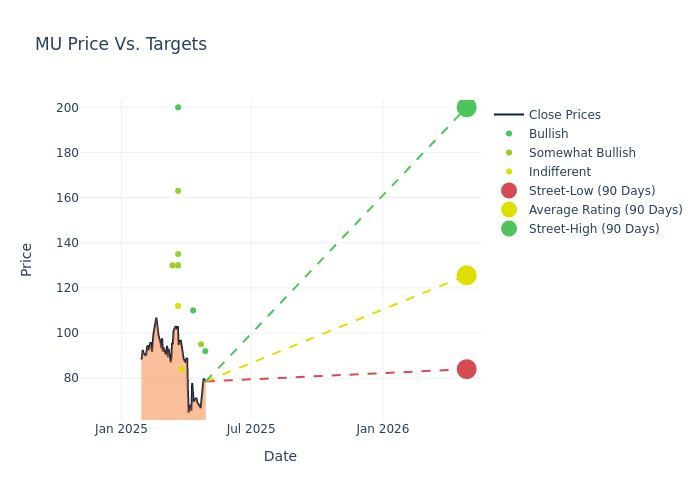

Analysts have recently evaluated Micron Technology and provided 12-month price targets. The average target is $124.73, accompanied by a high estimate of $200.00 and a low estimate of $84.00. Observing a downward trend, the current average is 7.41% lower than the prior average price target of $134.71.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Micron Technology by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |——————–|——————–|—————|—————|——————–|——————–| |Timothy Arcuri |UBS |Lowers |Buy | $92.00|$130.00 | |Tom O’Malley |Barclays |Lowers |Overweight | $95.00|$115.00 | |Christopher Danely |Citigroup |Lowers |Buy | $110.00|$120.00 | |Guohan Wang |China Renaissance |Announces |Hold | $84.00|- | |Christopher Danely |Citigroup |Lowers |Buy | $120.00|$150.00 | |Tom O’Malley |Barclays |Raises |Overweight | $115.00|$110.00 | |Joseph Moore |Morgan Stanley |Raises |Equal-Weight | $112.00|$91.00 | |Harlan Sur |JP Morgan |Lowers |Overweight | $135.00|$145.00 | |Matt Bryson |Wedbush |Raises |Outperform | $130.00|$125.00 | |Matthew Prisco |Cantor Fitzgerald |Maintains |Overweight | $130.00|$130.00 | |Tristan Gerra |Baird |Raises |Outperform | $163.00|$130.00 | |Kevin Cassidy |Rosenblatt |Lowers |Buy | $200.00|$250.00 | |Timothy Arcuri |UBS |Raises |Buy | $130.00|$125.00 | |Matt Bryson |Wedbush |Maintains |Outperform | $125.00|$125.00 | |Aaron Rakers |Wells Fargo |Lowers |Overweight | $130.00|$140.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they ‘Maintain’, ‘Raise’ or ‘Lower’ their stance, it reflects their response to recent developments related to Micron Technology. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from ‘Outperform’ to ‘Underperform’. These ratings convey the analysts’ expectations for the relative performance of Micron Technology compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Micron Technology’s stock. This comparison reveals trends in analysts’ expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Micron Technology’s market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Micron Technology analyst ratings.

Get to Know Micron Technology Better

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

Micron Technology’s Economic Impact: An Analysis

Market Capitalization Analysis: Below industry benchmarks, the company’s market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Positive Revenue Trend: Examining Micron Technology’s financials over 3M reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 38.27% as of 28 February, 2025, showcasing a substantial increase in top-line earnings. When compared to others in the Information Technology sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company’s net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 19.66%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Micron Technology’s ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 3.32%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company’s ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 2.19%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Micron Technology’s debt-to-equity ratio is below the industry average. With a ratio of 0.31, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

Breaking: Wall Street’s Next Big Mover

Benzinga’s #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.