ROAD TOWN, British Virgin Islands, April 01, 2025 (GLOBE NEWSWIRE) — Aura Minerals Inc. (TSX: ORA) (B3: AURA33) (OTCQX: ORAAF) (“Aura” or the “Company”) is pleased to report updated Mineral Reserves and Mineral Resources (“MRMR”) for its four operating mines: Aranzazu Mine, Apoena Mines, Minosa Mine and Almas Mine, as well as its development projects including Borborema and Matupá, as reported in the Annual Information Form for the year ended December 31, 2024 (“2024 AIF”). Readers are encouraged to read the 2024 AIF and Technical Reports (as defined herein), which have been filed on SEDAR+ at www.sedarplus.ca. Consolidated MRMR tables are noted below. Between 2023 and 2024, Aura updated its MRMR models to reflect new data and ensure transparency. Updates were driven by exploration drilling, revised geological interpretations, changes in mining methods, extraction plans, and economic parameters, including commodity prices that impacted cut-off grades and reserve classification.

Rodrigo Barbosa, President and CEO of Aura commented, “Reflecting on another year of disciplined execution and strategic focus, Aura drilled over 100,000 meters across its portfolio, investing US$21.8 million in exploration and achieving one of the industry’s lowest discovery costs at US$22.00 per ounce. Our Proven and Probable Reserves held steady at 3.4 million GEO, showcasing portfolio resilience despite natural depletion. Notable reserve growth at Apoena extended its life-of-mine (LOM) to seven years, assuming a 1.6 Mt throughput, partially offsetting reductions elsewhere. Measured and Indicated Resources grew by 1% (GEO) post-depletion, bolstered by successful infill and extension drilling at Apoena and Almas, while Inferred Resources increased by 4%, driven by discoveries at Nosde-Lavrinha and the new Esperanza and BW-Connection zones at Aranzazu.

As further upside we highlight: (i) Matupa: drilling at Pé Quente and Pezão, near our X1 deposit, which yielded promising bulk-tonnage intercepts; (ii) Almas: continued success at Paiol showcasing underground potential to extend Almas’ LOM; (iii) Borborema: further progress on relocating the federal road which should significantly improve mineral reserves; (iv) Cerro Blanco: early-stage work positions us for long-term growth, pending approvals to start operations, while we advance on the definitive feasibility study scheduled for late 2025; and (v) Carajas: confirmed multiple mineralized zones with IOCG-type mineralization. Drilling activities are planned for 2025 to improve the level of data reliability, while advancing metallurgical studies to support a PEA in the coming years.“

Highlights:

- In 2024, Aura executed 100,535m of drilling with a total exploration spend, inclusive of capex, of US$21.8 million, maintaining a low global discovery cost. The Company’s strategy balanced near-term mine life extension with a strong focus on long-term growth, advancing greenfield and brownfield targets while leveraging strategic M&A to expand its future resource base.

- Consolidated Proven & Probable (“P&P”) Mineral Reserves were maintained and totaled 3,438k GEO, representing a 3% net annual decrease, primarily due to depletion. Net reserve reductions at Aranzazu, Almas, and Minosa mines were mostly offset by gains at Apoena.

- Measured & Indicated (M&I) Mineral Resources increased 1% to 6,443k GEO, driven by 57Koz increase at Apoena’s Nosde-Lavrinha mines, (after depletion) leveraging new assay results from the 2023-2024 drilling campaigns not previously incorporated in the 2023 long term model. Almas also contributed a notable 72Koz Au increase (after depletion).

- Inferred Mineral Resources increased by 4% to 1,076k GEO, primarily driven by a 118% increase in Inferred Mineral Resource gold ounces at Apoena compared to 2023 following successful exploration at the Nosde-Lavrinha ore body. Aranzazu also contributed with an 11% increase in Inferred Mineral Resource GEO compared to 2023, supported by the addition of the Esperanza and BW-Connection zones.

- Metal price assumptions used for estimating Mineral Reserves were updated to reflect a significantly higher pricing environment while maintaining a conservative outlook: gold at US$2,000/oz (up from US$1,800), copper at US$4.20/lb (up from US$4.00), and silver at US$25.00/oz (up from US$22.00).

Strong Ongoing Exploration Growth Trajectory:

- Pé Quente and Pezão (Matupá Project):In 2024, Aura acquired the right to explore the Pé Quente and Pezão Projects. Located in the State of Mato Grosso, Brazil, these projects, encompassing six mineral rights, are strategically situated near our Matupá Project. They represent the potential to enhance the mineral resources and reserves of the Matupá Project. The acquisition of the exploration rights over the projects consisted of an initial payment of US$500,000 with an option, but not the obligation, to acquire the projects for an additional US$9.5 million if exploratory results are favorable, which option shall expire if not exercised within 12 months from May 22, 2024. At Pé Quente, drilling confirmed historical high-grade gold intercepts and identified new zones, extending the mineralization footprint. Initial infill drilling (9,190m in 48 holes) at Pé Quente returned several broad intercepts including 132m at 0.96 g/t Au (see press release dated December 8,2024), These results underscore Aura’s effective exploration strategy and its commitment to resource and reserve expansion.

- Almas Mine (Paiol Deposit): Drilling at the Paiol deposit confirmed the continuity of high-grade gold mineralization below the current pit shell, supporting the potential for underground development which is not disclosed in the 2024 MRMR report. Five holes were drilled, totaling 3,208.95m. The assays returned positive results (see press release dated December 8, 2024) showing the continuity of high-grade ore at depth and follow up drilling is planned for 2025 to continue assessing the potential for scalable, andhigh-grade mineralization for an underground operation.

In Q1 2025, Aura continued to test the down dip potential continuity in Paiol, with infill and extension drilling. The drilling will be completed with conventional and directional holes, taking advantage of the holes drilled in 2024 that are still coated.

- Carajás: During 2023 and 2024, Aura completed over 21,000m of drilling, confirming continuous mineralization along a 7 km strike, delineating three key zones (Trend S, Trend SW, Trend N – Regional). The results highlight the target’s strong potential. Assay results indicate copper grades range from 0.2% Cu to 0.5% Cu with a thickness of approximately 50m, associated mainly with disseminated sulphides in hydrothermally altered rocks. Within these broader zones, high-grade copper zones (>0.5% Cu) with a typical thickness of 15 to 20m, characterized by vein-hosted mineralization, were identified. Additionally, semi-massive sulphide zones with high-grade copper (>1% Cu) were observed, with an average thickness of approximately 5m (not true width) (see press release dated December 8, 2024). Drilling activities are planned for 2025 to improve the level of data reliability, while advancing metallurgical studies. The company expects to advance studies for PEA in the coming years.

- Cerro Blanco: Acquired in January 2025 (see press release dated January 13, 2025), Aura plans to conduct a definitive feasibility study this year, evaluating all development scenarios within the scope of existing Guatemalan permits. Options under review include an underground mine and process plant, as well as a potential open-pit configuration that would not interfere with the underground infrastructure.

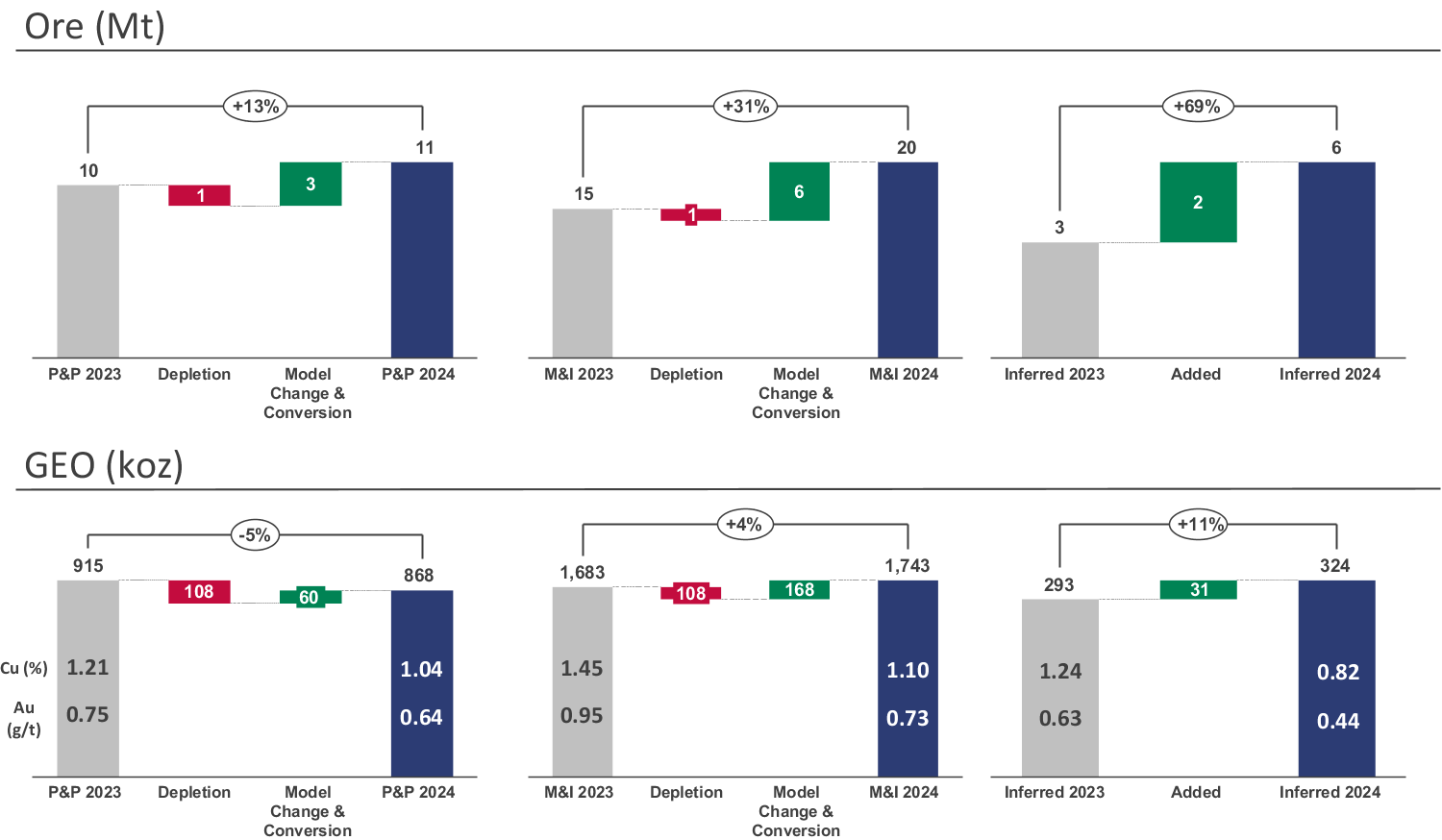

Aranzazu, Mexico

Infill and deep drilling campaigns from 2018 to 2024 in the Glory Hole (GH) zone have been successful in extending known mineralization. Although the lateral continuity of the skarn is poor in the GH zone, the zone remains open at depth with returned economic grades and thicknesses. Drilling campaigns in 2024 confirmed the extension of skarn mineralization in the Esperanza zone, with promising copper and gold grades, while further drilling is planned to explore its full potential.

P&P Mineral Reserves increased by 1,342 kt (13%) compared to 2023, supporting an LOM to 2034. While total tonnage grew, lower average grades led to a 2% decrease in contained copper and a 3% decrease in contained gold.

M&I Mineral Resources increased by 4% in GEO compared to 2023, primarily driven by the conversion of Inferred Resources to the M&I category. Inferred Mineral Resources increased by 68% in tonnes and 11% in GEO mainly due to the addition of Esperanza and BW-connection zones.

Inferred Mineral Resources increased by 69% in tonnes and 11% in GEO mainly due to the addition of Esperanza and BW-connection zones.

In addition, during the year, Aura initiated molybdenum (Mo) recovery at the Aranzazu processing plant, unlocking additional by-product value. Backed by a US$1.3 million investment and a 9-month payback period, the new circuit is expected to add 3.0–3.5 koz GEO annually. With continued development, there is potential for Mo to be incorporated into future Mineral Resource estimates.

The charts below show changes in P&P Mineral Reserves, M&I Mineral Resources and Inferred Mineral Resources for the Aranzazu Mine as of December 31, 2024 compared to December 31, 2023.

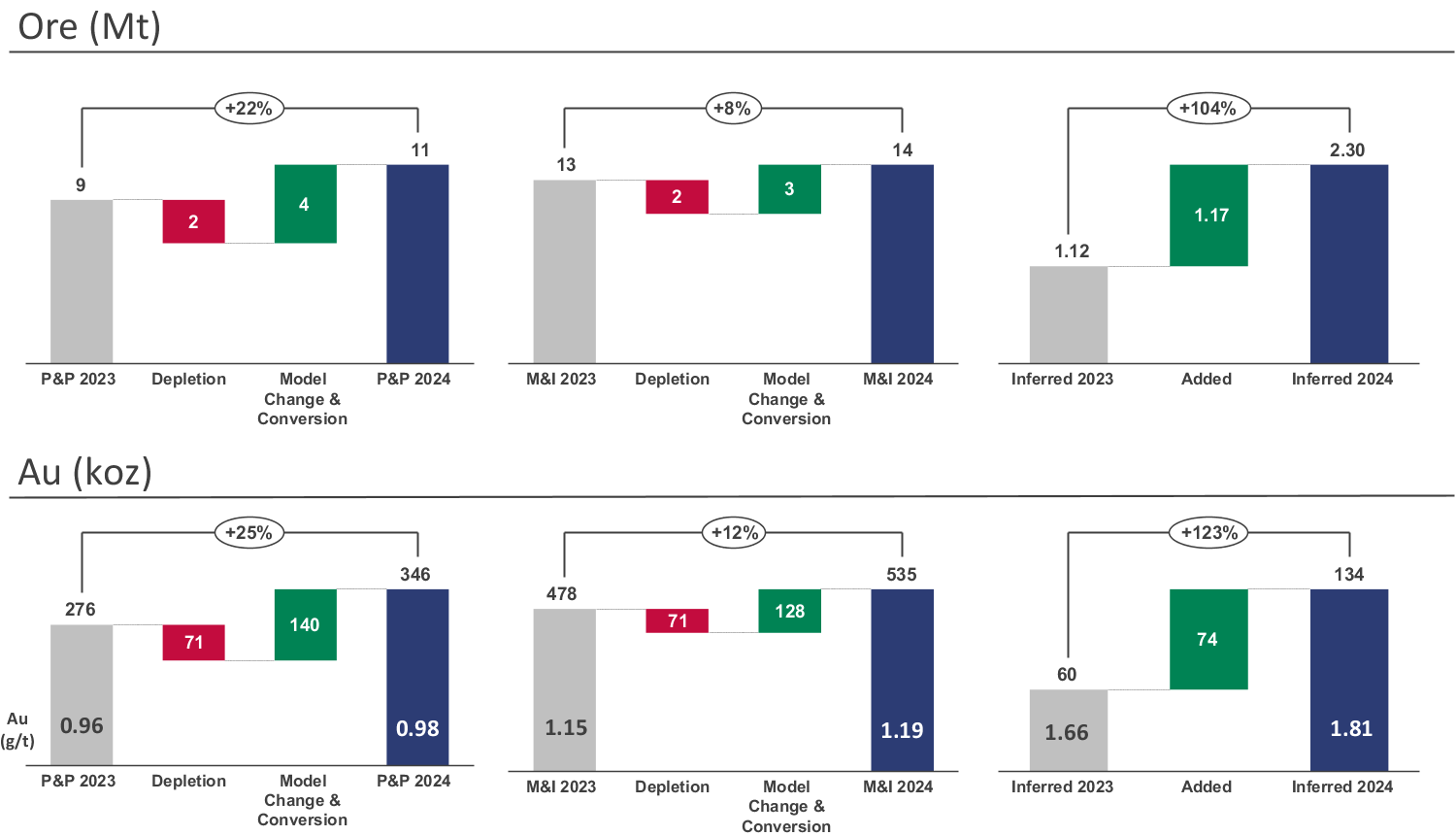

Apoena, Brazil

Recent exploration at Apoena focused on closing the gap between the Nosde and Lavrinha mines, enabling a combined pit design that incorporates mineralization within the connecting schist layer. Infill drilling confirmed the continuity of the Upper Trap zone, adding new resources to the Mineral Resource inventory. At Nosde, drilling also converted existing resources and confirmed mineralization at depths of 300m and 450m (Middle and Lower Traps), with an average depth of 380m. Drilling in the connection zone further improved geological understanding of local mineralization.

P&P Mineral Reserves included the replacement of 100% of depleted ounces with a net 69Koz added, representing a 25% increase in ounces.

M&I Mineral Resources included the conversion of 128Koz (before depletion) of gold from Inferred Resources replacing depletion.

Notably, Inferred Mineral Resources increased by 123% as a result of infill and exploration drilling in Nosde and Lavrinha mines.

The charts below show changes in P&P Mineral Reserves Estimates, M&I Mineral Resources Estimates and Inferred Mineral Resources Estimates for Apoena as of December 31, 2024 compared to December 31, 2023.

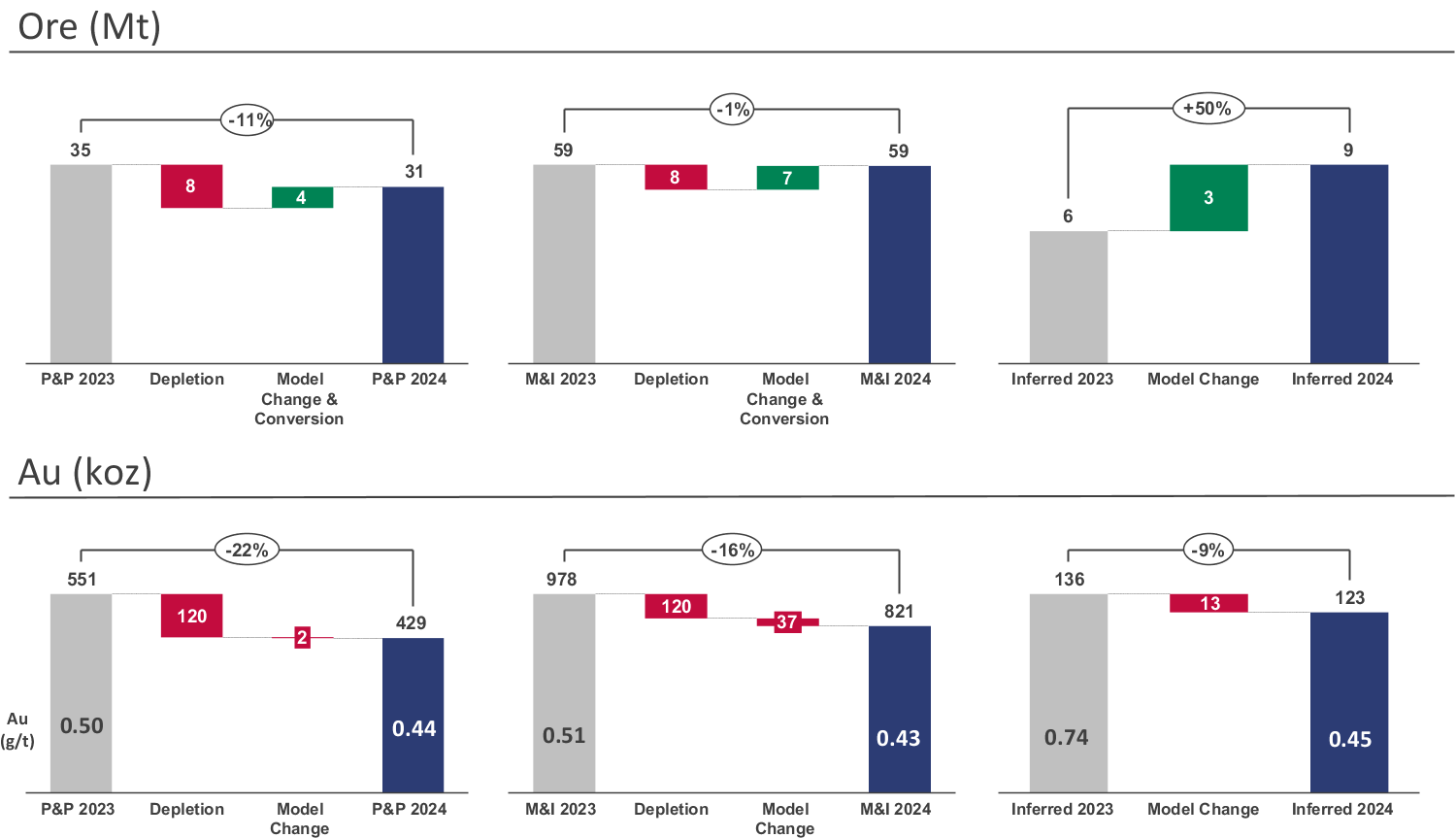

Minosa (San Andres), Honduras

Proven and Probable (P&P) Mineral Reserves decreased by 22% as result of depletion from production in 2024. Contributing factors also included constrained pit geometry, more conservative modifying factors, and the transition to deeper, unrecoverable sulphide mineralization.

M&I Mineral Resources decreased by 16% and Inferred Resources decreased by 9% due to changes in the model.

The charts below show changes in P&P Mineral Reserves Estimates, M&I Mineral Resources Estimates and Inferred Mineral Resources Estimates for Minosa as of December 31, 2024 compared to December 31, 2023.

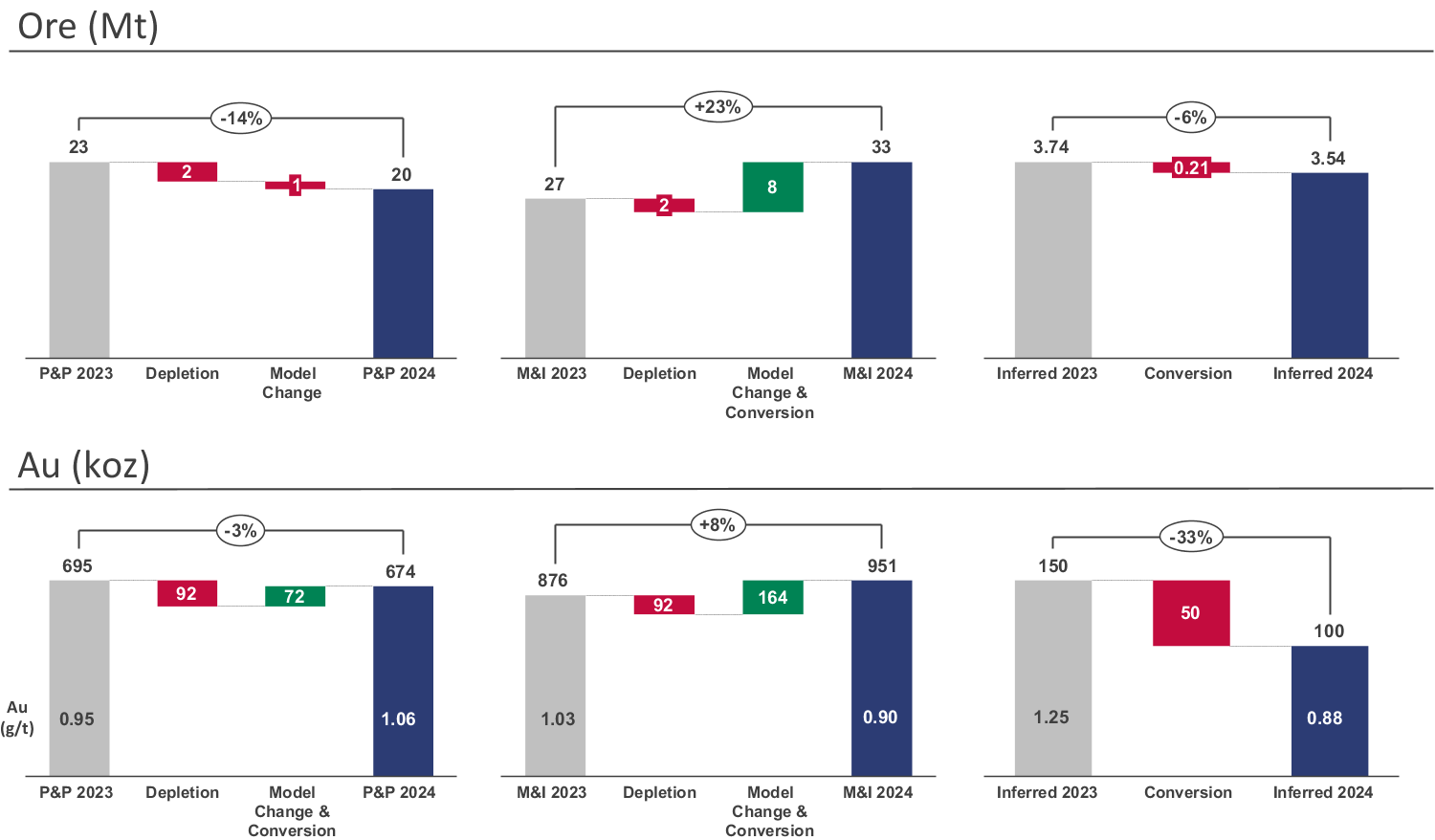

Almas, Brazil

Almas, Aura’s first greenfield project, began commercial production in September 2023 and has outperformed expectations. Originally forecast to produce 51koz annually in its first four years, it delivered 54koz in 2024 following a successful plant expansion. As part of Aura’s strategy to bring mines online quickly and focus on exploration-driven growth, the Company has been actively drilling at Almas. Early results point to strong potential to grow both reserves and resources in the future, especially with underground potential at the Paiol pit. Due to active drilling during the preparation of the Technical Report, assay results from underground drilling were not included in the 2024 AIF, suggesting further upside beyond the current 10-year mine life.

Proven and Probable (P&P) Mineral Reserves decreased 3% after depletion. While total tonnes declined, a 23% improvement in gold grades resulted in a 4% increase in contained gold.

M&I Mineral Resources increased 8% due to conversion and additions to the model changes, reclassification and inclusion of infill drilling from Vira Saia and Paiol.

Similarly, Inferred Mineral Resources decreased 33% resulting from conversion.

It is important to note that none of the Mineral Resource categories include Paiol underground drilling completed in 2024. Additional work is required to evaluate the economic viability of underground potential.

The charts below show changes in P&P Mineral Reserves Estimates, M&I Mineral Resources Estimates and Inferred Mineral Resources Estimates for Almas as of December 31, 2024 compared to December 31, 2023.

Borborema, Brazil

Borborema is the second project Aura has brought online on time and on budget. With ramp-up now underway, the mine and plant are operational, and Aura expects to achieve commercial production by Q3 2025.

A Feasibility Study completed in August 2023 outlined anticipated production of 748koz of gold over an initial 11.3-year mine life, with strong potential for further growth. The project is underpinned by robust Probable Mineral Reserves of 812koz of gold and a significant resource base of 2.08Moz Indicated and 393koz Inferred. Permitting is in progress to relocate a nearby road, which, once completed, could allow for the conversion additional Indicated Resources into Mineral Reserves, subject to future modifying factors such as gold price and exchange rates.

Matupá, Brazil

Since the completion of the Feasibility Study in 2022, Aura has continued to advance regional exploration at Matupá, with the goal of identifying and developing satellite deposits to support long-term growth. Exploration and extension drilling programs have been a key focus, targeting numerous gold occurrences and anomalies within a 50km radius of the X1 deposit. These efforts have been supported by surface work including soil and rock sampling, geological mapping, drill core re-logging, and geophysical surveys to enhance geological understanding and guide future targeting.

In 2024, Aura acquired the Pezão and Pe Quente projects and drilled significant intercepts, although the data is still in progress, and as a result, was not considered in the 2024 AIF.

At the Serrinhas target, scout and extension drilling continued at the MP2 West and MP2 East zones using both conventional and directional diamond core drilling. These programs were guided by a detailed 1,200 km drone magnetometer survey and supported by full core re-logging across the prospect, enhancing geological understanding and drill targeting.

The Company plans to continue evaluating the area surrounding the X1 deposit to identify additional resource potential and support the long-term growth of the Matupá Project.

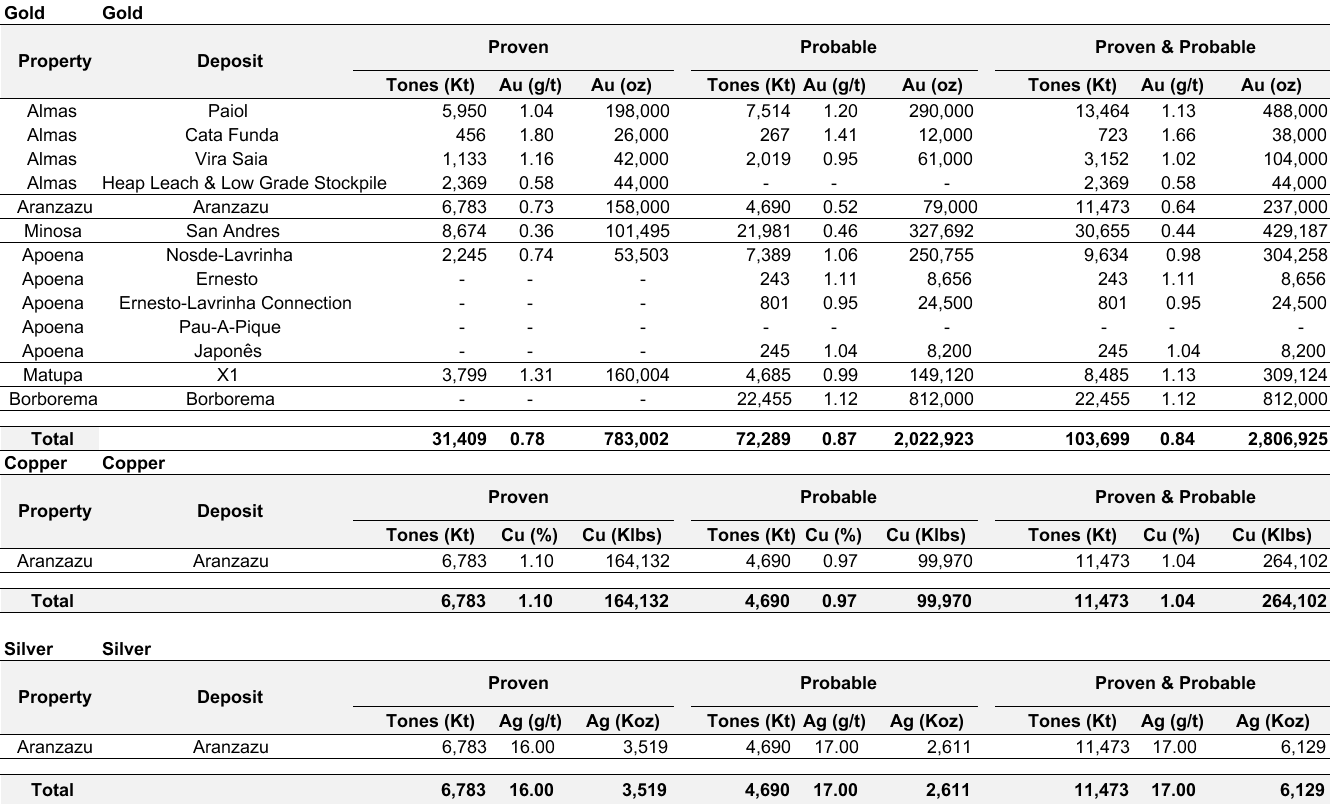

The complete 2024 MRMR estimates for all tonnage, metal grades, and metal content are shown below in the following tables:

Table 1: Proven & Probable Mineral Reserve Estimates

Notes:

- The Mineral Reserve estimates were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Reserves are the economic portion of the Measured and Indicated Mineral Resources. Mineral Reserve estimates include mining dilution and mining recovery. Mining dilution and recovery factors vary with specific reserve sources and are influenced by several factors including deposit type, deposit shape and mining methods.

- The estimate of Mineral Reserves may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- The disclosure of the Mineral Reserve estimates and related scientific and technical information for the Aranzazu, San Andres, and Almas Mines has been prepared by qualified persons employed by SLR, as a company whose primary business is providing engineering or geoscientific services and qualified to sign each respective technical report under NI 43-101.

- The Mineral Reserve estimate for the Apoena Mines was prepared under the supervision Farshid Ghazanfari, P.Geo. as a Qualified Person as defined by NI 43-101, qualified to execute the EPP Technical Report under NI 43-101.

- Mineral Reserve estimates for the Matupá Gold Project was prepared under the supervision of Luiz Pignatari, P.Eng. as a Qualified Person as defined by NI 43-101, qualified to execute the Matupá Technical Report under NI 43-101.

- The Qualified Person for the Borborema Reserve Estimate is Bruno Yoshida Tomaselli, B.Sc., FAusIMM, an employee of Deswik.

- Mineral Reserves are estimated at an NSR cut-off value of US$66.48/tonne in Aranzazu.

- Mineral Reserves are estimated using an average long-term price of US$2,000/oz Au, US$4.20/lb Cu, and US$25.00/oz Ag, metallurgical recoveries of 91.3% Cu, 79.5% Au, and 62.8% Ag, and a US$/MXN exchange rate of 1:20.5. The NSR formula is as follows: NSR = 74.553 x Cu (%) + 47.932 x Au (g/t) + 0.431 x Ag (g/t). A minimum mining width of 2.0 m was used.

- Mineral Reserves are calculated using pit designs, which have been optimized using only Measured and Indicated Resources at US$2,000/oz. gold price in the San Andres, Apoena and Almas mines.

- Mineral Reserves have been estimated at a cut-off grade of 0.215 g/t for oxide material and 0.334 g/t for mixed material, with dilution of 5% and mining recovery of 95% in San Andres.

- Mineral Reserves were estimated at a cut-off grade of 0.47 g/t Au and applying 20% dilution factor with 98% mining recovery in Nosde & Lavrinha Mines (Apoena).

- Mineral Reserves were estimated at a cut-off grade of 0.47 g/t Au and applying 20 % dilution factor with 98% mining recovery in Ernesto mine (Apoena).

- Mineral Reserve were estimated at cut-off grade of 0.47 g/t Au and applying 40% dilution factor and 98% mining recovery, in Japonês mine (Apoena).

- Mineral Reserves were estimated at cut-off grade of 0.47 g/t Au and applying 40% dilution factor and 98% mining recovery in Ernesto-Lavrinha Connection mine (Apoena).

- The Mineral Reserve estimate is based on an updated optimized shell using 2,000 US$/oz gold price, average dilution of 10%, mining recovery of 100% and break-even cut off grades of 0.40 g/t Au for Vira Saia and 0.42 g/t Au for Cata Funda in Almas.

- The Mineral Reserves estimate for Paiol Mine is based on a designed pit using only Measured and Indicated resources, which has been optimized using $2,000/oz. gold price. Mineral Reserve were estimated at cut-off grade of 0.38 g/t Au, 10% dilution factor and 100% mining recovery.

- Mineral Reserves for Borborema are confined within an optimized pit shell that uses the following parameters: gold price including refining costs US$1,472/oz; mining costs US$2.40/t weathered material, US$2.80/t waste fresh rock, US$3.20/t ore fresh rock; processing costs US$14.82/t processed; general and administrative costs US$2.8 M/a; sustaining costs US$0.62/t processed; process recovery of 92.1%; mining dilution of 5%; ore recovery of 95%; and pit inter-ramp angles that range from 36–64°.

- The Mineral Reserve estimate is based on an updated optimized shell using US$1,500/oz gold price, average dilution of 3%, mining recovery of 100% and break-even cut off grades of 0.35 g/t Au for X1 pit in Matupá.

- Surface topography as of December 31, 2024, and a 200m river offset restrictions have been imposed, in San Andres.

- Surface topography based on December 31, 2024 in Apoena Mines.

- Surface topography based on December 31, 2024 in Almas.

- Surface topography as of July 31, 2021, in Matupá.

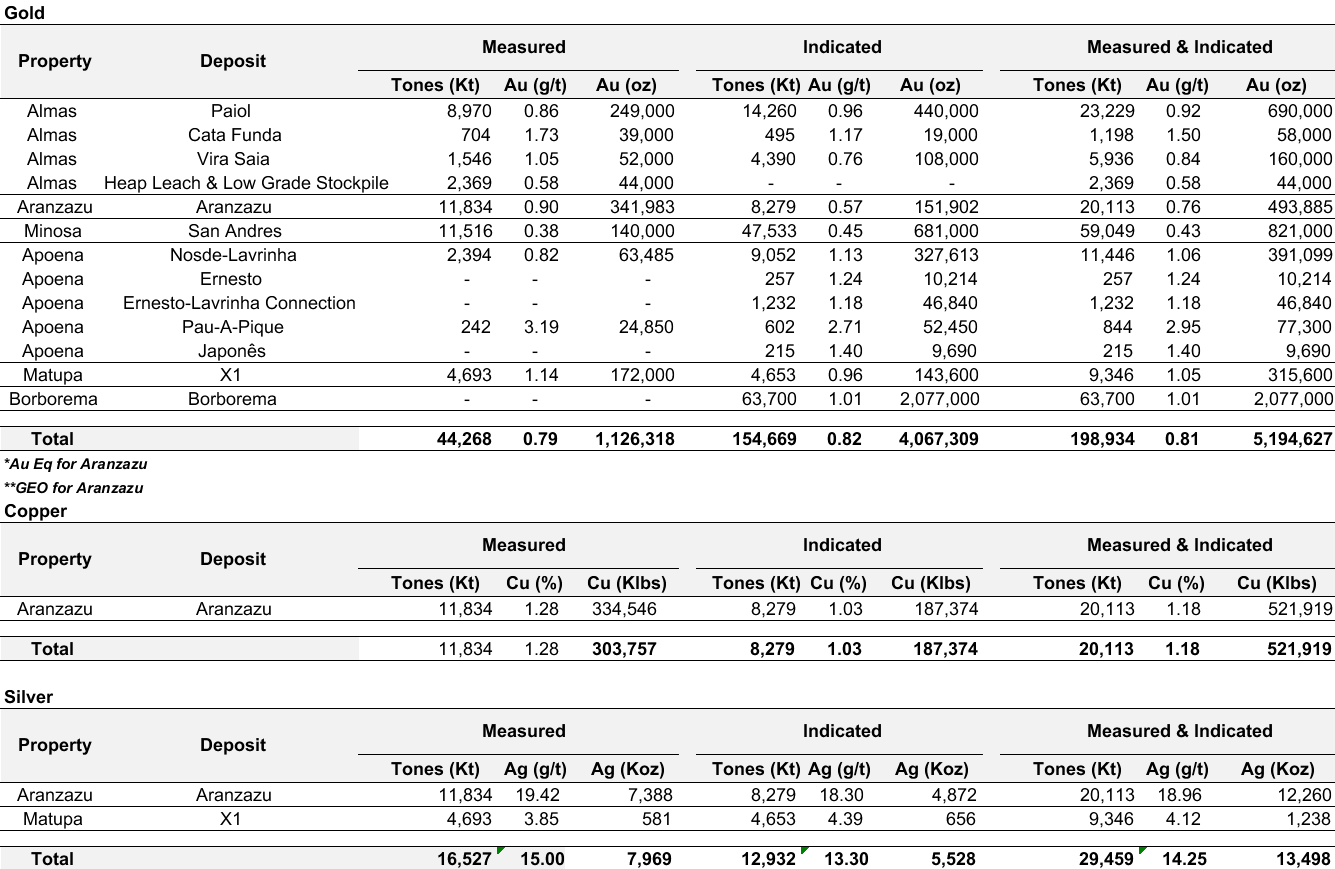

Table 2: Measured and Indicated Mineral Resource Estimates

Notes:

- The Mineral Resource estimates were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- The SLR consultants (Canada) are Qualified Persons for Aranzazu, San Andres (Minosa) and Almas mines.

- The disclosure of the Mineral Resource estimates and related scientific and technical information has been prepared under the supervision or is approved by Farshid Ghazanfari, P.Geo. as a Qualified Person Apnoea (EPP) and Matupá

- The Qualified Person for Borborema Mineral Resources is Erik Ronald, P. Geo (PGO #3050), Principal Consultant with SRK Consulting (U.S.), Inc. based in Denver, USA.

- Contained metal figures may not add due to rounding.

- Mineral Resources stated at a cut-off of US$50/t NSR for Aranzazu. NSR values have been calculated using a long-term price forecast for copper (US$4.20/lb), gold (US$2,000/oz) and silver (US$25/oz), resulting in the following formula: NSR = 74.553 x Cu (%) + 47.932 x Au (g/t) + 0.431 x Ag (g/t).

- Estimated bulk density ranges between 2.03 t/m3 and 5.51 t/m3.

- The figures only consider material classified as sulphide mineralization for Aranzazu.

- The Mineral Resources estimate is based on optimized shell using US$2,200/oz gold for San Andres.

- The cut-off grade used was 0.187 g/t for oxide material and 0.291 g/t for mixed material in San Andres.

- A density model based on rock type was used for volume to tonnes conversion with averaging 2.38 tonnes/m3 in San Andres.

- Surface topography as of December 31, 2024, and a 200m river offset restrictions have been imposed in San Andres.

- The Mineral Resources are based on an optimized pit shell using US$2,200/oz gold and at a cut-off grade of 0.39 g/t Au in Apoena mines (EPP), except Pau-A-Pique.

- The Mineral Resource is based on a cut-off grade of 1.34 g/t Au and minimum width of 2m in Pau-A-Pique mine (EPP).

- Mineral Resources are estimated from the 410m EL to the 65m EL, or from approximately 30m depth to 500m depth from surface in Pau-A-Pique mine (EPP).

- Surface topography based on December 31, 2024 in EPP, except Pau-A-Pique mine.

- Density models based on rock types were used for volume to tonnes conversion with resources averaging 2.78 tonnes/m3 in Nosde-Lavrinhas mines for schist and 2.71 for meta-arenite and 2.77 tonnes/m3 in Pau-A-Pique mine, 2.65 tonnes/m3 in Ernesto mine, 2.76 tonnes/m3 in Japonês mine.

- The Mineral Resource estimates are based on an updated optimized shell using 2,500 US$/oz gold price and cut-off grades of 0.34 g/t and 0.32 g/t for Cata Funda and Vira Saia respectively, in Almas.

- The Mineral Resources are based on an optimized pit shell using US$2,500/oz gold and at a cut-off grade of 0.31 g/t Au in Paiol Mine.

- Bulk density is 2.75 t/m3 for Paiol, 2.71 t/m3 for Cata Funda and 2.63 t/m3 for Vira Saia.Surface topography based on December 31, 2024, in Almas.

- The Measured and Indicated Mineral Resources are contained within a limiting pit shell (using a gold price of US$ 1,800 per ounce Au) in Matupá.

- The base case cut-off grade for the estimate of Mineral Resources is 0.35 g/t Au in Matupá.

- Surface topography used in the models was surveyed July 31, 2021 in Matupá.

- The economic cut-off grade for Borborema Mineral Resources is based on the long-term outlook sale price of US$1,800/troy ounce of gold, 92.1% recovery, average mining costs of US$2.00/t, processing costs of US$14.82/t, G&A of US$1.38, and sustaining capital costs of US$0.62/t.

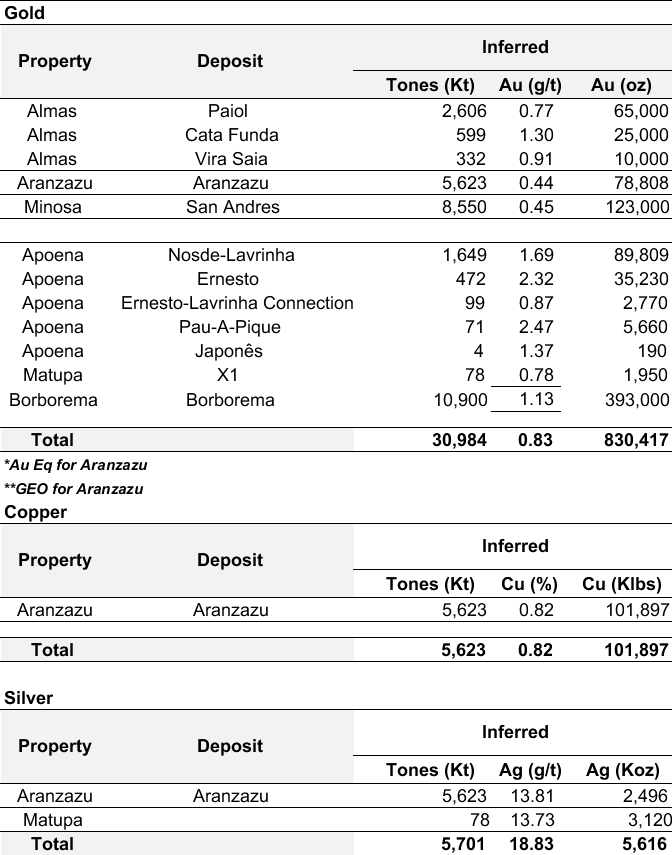

Table 3: Inferred Mineral Resource Estimates

Notes:

- The Mineral Resource estimates were prepared in accordance with the CIM Definition Standards for Mineral Resources and Mineral Reserves, adopted by the CIM Council on May 10, 2014, and the CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines, adopted by CIM Council on November 29, 2019, using geostatistical and/or classical methods, plus economic and mining parameters appropriate to the deposit.

- Mineral Resources are inclusive of Mineral Reserves. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues.

- The SLR consultants (Canada) are Qualified Persons for the Aranzazu, San Andres (Minosa) and Almas mines.

- The disclosure of the Mineral Resource estimates and related scientific and technical information for Apoena (EPP) and Matupá has been prepared under the supervision or is approved by Farshid Ghazanfari, P.Geo. as a Qualified Person.

- The Qualified Person for Borborema Mineral Resources is Erik Ronald, P. Geo (PGO #3050), Principal Consultant with SRK Consulting (U.S.), Inc. based in Denver, USA.

- Contained metal figures may not add due to rounding.

- Mineral Resources stated at a cut-off of US$50/t NSR for Aranzazu. NSR values have been calculated using a long-term price forecast for copper (US$4.20/lb), gold (US$2,000/oz) and silver (US$25/oz), resulting in the following formula: NSR = 74.553 x Cu (%) + 47.932 x Au (g/t) + 0.431 x Ag (g/t).

- Estimated bulk density ranges between 2.03 t/m3 and 5.51 t/m3.

- The cut-off grade used was 0.187 g/t for oxide material and 0.291 g/t for mixed material in San Andres.

- A density model based on rock type was used for volume to tonnes conversion with averaging 2.38 tonnes/m3 in San Andres.

- Surface topography as of December 31, 2024, and a 200m river offset restrictions have been imposed in San Andres.

- The Mineral Resources are based on an optimized pit shell using US$2,200/oz gold and at a cut-off grade of 0.39 g/t Au in Apoena mines (EPP), except Pau-A-Pique.

- Based on a cut-off grade of 1.34 g/t Au and minimum width of 2m in Pau-A-Pique mine (EPP).

- Mineral Resources are estimated from the 410m EL to the 65m EL, or from approximately 30m depth to 500m depth from surface in Pau-A-Pique mine (EPP).

- Surface topography based on December 31, 2024 in EPP, except Pau-A-Pique mine.

- Density models based on rock types were used for volume to tonnes conversion with resources averaging 2.78 tonnes/m3 in Nosde-Lavrinhas mines for schist and 2.71 for meta-arenite and 2.77 tonnes/m3 in Pau-A-Pique mine, 2.65 tonnes/m3 in Ernesto mine, 2.76 tonnes/m3 in Japonês mine.

- The Mineral Resource estimates are based on an updated optimized shell using 2,500 US$/oz gold price and cut-off grades of 0.34 g/t and 0.32 g/t for Cata Funda and Vira Saia respectively, in Almas.

- The Mineral Resources are based on an optimized pit shell using US$2,500/oz gold and at a cut-off grade of 0.31 g/t Au in Paiol Mine.

- Bulk density is 2.75 t/m3 for Paiol, 2.71 t/m3 for Cata Funda and 2.63 t/m3 for Vira Saia.Surface topography based on December 31, 2024, in Almas.

- The Measured and Indicated Mineral Resources are contained within a limiting pit shell (using a gold price of US$ 1,800 per ounce Au) and comprise a coherent body in Matupá (X1 Deposit).

- The base case cut-off grade for the estimate of Mineral Resources is 0.35 g/t Au in Matupá (X1 Deposit).

- Surface topography used in the models was surveyed July 31, 2021 in Matupá (X1 Deposit).

- Inferred Resources are reported only as in-situ for Ernesto mine which only can be mined by an underground operation. Inferred (UG) Mineral Resources are reported at a cut-off grade of 1.5 g/t.

- The economic cut-off grade for Borborema Mineral Resources is based on the long-term outlook sale price of US$1,800/troy ounce of gold, 92.1% recovery, average mining costs of US$2.00/t, processing costs of US$14.82/t, G&A of US$1.38, and sustaining capital costs of US$0.62/t.

Quality Assurance and Quality Control

Aura incorporates a rigorous Quality Assurance and Quality Control (“QA/QC”) program for all of its four mines and exploration projects which conforms to industry best practices as outlined by NI 43-101.

For a complete description of Aura’s sample preparation, analytical methods and QA/QC procedures, please refer to 2024 AIF and the applicable Technical Report, a copy of which is available on the Company’s SEDAR+ profile at www.sedarplus.ca.

Qualified Persons

The scientific and technical information contained in this press release has been reviewed and approved by Farshid Ghazanfari, P.Geo., Geology and Mineral Resources Manager who is an employee of Aura and a “qualified person” within the meaning of NI 43-101.

Technical Reports

All information of scientific and technical nature has been derived from the Technical Reports and any information arising since the date of the Technical Reports has been prepared under the supervision of Farshid Ghazanfari, P. Geo. Readers are encouraged to read the following technical reports for the following mineral properties of the Company:

- Aranzazu: The technical report dated March 31, 2025, with an effective date of December 31, 2024, and entitled “NI 43-101 Technical Report Aranzazu Mine, Zacatecas, Mexico” prepared for Aura Minerals by Murray Dunn, P.Eng., Marie-Christine Gosselin, P.Geo., A. Paul Hampton, M.Sc., P.Eng., and Derek Riehm, M.A.Sc., P. Eng., all of SLR Consulting (Canada) Ltd. (the “Aranzazu Technical Report”);

- Apoena: The technical report dated April 1, 2024, with an effective date of October 31, 2023 and entitled “Apoena Mines (EPP Complex) Mineral Resource and Mineral Reserve”, prepared for Aura Minerals Inc. (“Aura” or the “Company”) by Porfirio Cabaleiro Rodriguez, Luiz Eduardo Campos Pignatari, Farshid Ghazanfari, Homero Delboni Junior, and Branca Horta de Almeida Abrantes (the “EPP Technical Report”), which was prepared in order to provide an NI 43-101 Technical Report on the Nosde, Lavrinha, Ernesto and Pau-a-Pique Deposits (the “Apoena Mines”, or the “EPP Complex”, “EPP Project” or “EPP Property”);

- San Andres: The technical report dated March 31, 2025, with an effective date of December 31, 2024, and entitled “ NI 43-101 Technical Report San Andrés Mine, Department of Copán, Honduras” prepared for Aura Minerals by B. Sanfurgo Cid, ChMC(RM), E. Zamanillo, M.Sc., MBA, ChMC(RM), Andrew P. Hamptor, P.Eng., and Derek J. Riehm, P. Eng., all of SLR Consulting (Canada) Ltd. (the “San Andres Technical Report”).;

- Almas: The technical report dated March 31, 2025, with an effective date of December 31, 2024, authored by Antonio Caires, FAusIMM CP (Min), Linda M. Dufour, P.Eng., Renan Lopes, M.Sc., MAusIMM CP (Gwo), P.Geo., and Derek J. Riehm, M.A.Sc., P.Eng (all from SLR Consulting (Canada) Ltd.) and titled “ NI 43-101 Exec Summary Almas Project, Tocantins State, Brazil” (the “Almas Technical Report”);

- Borborema: The “Feasibility Study Technical Report (NI 43-101) for the Borborema Gold Project, Currais Novos Municipality, Rio Grande do Norte, Brazil” (the “Borborema Technical Report”) dated October 5, 2023 with an effective date of July 12, 2023, authored by B. Tomaselli B.Sc., FAusIMM (Deswik, Belo Horizonte, Brazil), E. Ronald P.Geo, Principal Consultant with SRK Consulting (U.S.), Inc. Denver, USA., F. Ghazanfari. P.Geo. (Aura Minerals), and H. Delboni Jr. P.Eng. (Independent Mining Consultant, Brazil), and

- Matupá: The technical report entitled “Feasibility Study Technical Report (NI 43-101) for the Matupá Gold Project, Matupá Municipality, Mato Grosso, Brazil” (the “Matupá Technical Report”) dated November 18, 2022, with an effective date of August 31, 2022, authored by F. Ghazanfari. P.Geo. (Aura Minerals), L. Pignatari, P.Eng. (EDEM, Consultants, Brazil), and H. Delboni Jr. Ph.D. (Senior Consultant, Brazil)

About Aura Minerals

Aura is focused on mining in complete terms – thinking holistically about how its business impacts and benefits every one of our stakeholders: our company, our shareholders, our employees, and the countries and communities we serve. We call this 360° Mining.

Aura is a mid-tier gold and copper production company focused on operating and developing gold and base metal projects in the Americas. The Company has 5 operating mines including the Aranzazu copper-gold-silver mine in Mexico, the Apoena, Almas and Borborema gold mines in Brazil, and the Minosa (San Andres) mine in Honduras. The Company’s development projects include Cerro Blanco in Guatemala and Matupá both in Brazil. Aura has unmatched exploration potential owning over 630,000 hectares of mineral rights and is currently advancing multiple near-mine and regional targets along with the Carajas (Serra da Estrela) copper project in the prolific Carajás region of Brazil.

www.auraminerals.com

X: @AuraMineralsNA)

LinkedIn: aura-minerals-inc

Caution Regarding Forward-Looking Information and Statements

All statements other than statements of historical fact are forward-looking statements. Forward-looking statements relate to future events or future performance and reflect the Company’s current estimates, predictions, expectations or beliefs regarding future events and include, without limitation, statements with respect to: expected production from, and the further potential of the Company’s properties; the ability of the Company to achieve its longer-term outlook and the anticipated timing and results thereof; the ability to lower costs and increase production; the economic viability of a project; strategic plans, including the Company’s plans with respect to its properties; amounts of mineral reserves and mineral resources; the amount of future production over any period; capital expenditure and mine production costs; the outcome of mine permitting and other required permitting; the outcome of legal proceedings which involve the Company; information with respect to the future price of copper, gold, silver and other minerals; estimated mineral reserves and mineral resources; the Company’s exploration and development program; estimated future expenses; exploration and development capital requirements; operating costs; strip ratios and mining rates; expected grades and ounces of metals and minerals; expected processing recoveries; expected time frames; prices of metals and minerals; mine life; the ability of the Company to successfully maintain operations at its producing assets, or to restart these operations efficiently or economically, or at all; timing of anticipated technical reports on the properties; and the ability of the Company to continue as a going concern. Often, but not always, forward-looking statements may be identified by the use of words such as “expects”, “anticipates”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives” or variations thereof or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions.

Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by the Company, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements in Aura´s 2024 AIF are based upon, without limitation, the following estimates and assumptions: the presence of and continuity of metals at the Company’s projects at modeled grades; the capacities of various machinery and equipment; the availability of personnel, machinery and equipment at estimated prices; exchange rates; metals and minerals sales prices; appropriate discount rates; tax rates and royalty rates applicable to the mining operations; cash costs; anticipated mining losses and dilution; metals recovery rates, reasonable contingency requirements; our expected ability to develop adequate infrastructure at a reasonable cost; our expected ability to develop our projects including financing such projects; and receipt of regulatory approvals on acceptable terms.

Known and unknown risks, uncertainties and other factors, many of which are beyond the Company’s ability to predict or control could cause actual results to differ materially from those contained in the forward-looking statements. Specific reference is made to the section 11 of Aura´s 2024 AIF, entitled “Risk Factors”, for a discussion of some of the factors underlying forward-looking statements, which include, without limitation, risks related to exploration, development and operations, market fluctuations and commercial quantities of minerals, funding needs, liquidity and going concerns, foreign operations, government regulations, consents and approvals, stakeholders, increases in production costs, construction and development of new mines, infrastructure, concentration of customers, environmental and safety regulations and risks, competition, retention of key personnel, uncertainty in the estimation of mineral resources and reserves, replacement of depleted mineral reserves, production estimates, currency risk, write-downs and impairments, mineral titles, market price of Shares and Brazilian Depositary Receipts (“BDRs”), insurance and uninsured risks, public company obligations, tax matters, information technology, labour and employment matters, nature and climatic conditions, risks inherent in acquisitions, reputational risk, risks associated with transportation and storage of ingots or concentrate, risks associated with joint ventures, illegal activity, litigation, enforcement of judgments, interests of the controlling shareholder, dividend policy and global financial conditions. Readers are cautioned that the foregoing list of factors is not exhaustive of the factors that may affect the forward-looking statements.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

Caution Regarding Mineral Resource and Mineral Reserve Estimates

The figures for mineral resources and reserves contained herein are estimates only and no assurance can be given that the anticipated tonnages and grades will be achieved, that the indicated level of recovery will be realized or that the mineral resources and reserves could be mined or processed profitably. Actual reserves, if any, may not conform to geological, metallurgical or other expectations, and the volume and grade of ore recovered may be below the estimated levels. There are numerous uncertainties inherent in estimating mineral resources and reserves, including many factors beyond the Company’s control. Such estimation is a subjective process, and the accuracy of any reserve or resource estimate is a function of the quantity and quality of available data and of the assumptions made and judgments used in engineering and geological interpretation. Short-term operating factors relating to the mineral resources and reserves, such as the need for orderly development of the ore bodies or the processing of new or different ore grades, may cause the mining operation to be unprofitable in any particular accounting period. In addition, there can be no assurance that metal recoveries in small scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Lower market prices, increased production costs, the presence of deleterious elements, reduced recovery rates and other factors may result in revision of its resource and reserve estimates from time to time or may render the Company’s resources and reserves uneconomic to exploit. Resource and reserve data is not indicative of future results of operations. If the Company’s actual mineral resources and reserves are less than current estimates or if the Company fails to develop its resource base through the realization of identified mineralized potential, its results of operations or financial condition may be materially and adversely affected.

All forward-looking statements herein are qualified by this cautionary statement. Accordingly, readers should not place undue reliance on forward-looking statements. The Company undertakes no obligation to update publicly or otherwise revise any forward-looking statements whether as a result of new information or future events or otherwise, except as may be required by law. If the Company does update one or more forward-looking statements, no inference should be drawn that it will make additional updates with respect to those or other forward-looking statements.

CONTACT: For more information, please contact: Investor Relations [email protected]