In the preceding three months, 5 analysts have released ratings for First Business Finl Servs FBIZ, presenting a wide array of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 0 | 0 | 0 |

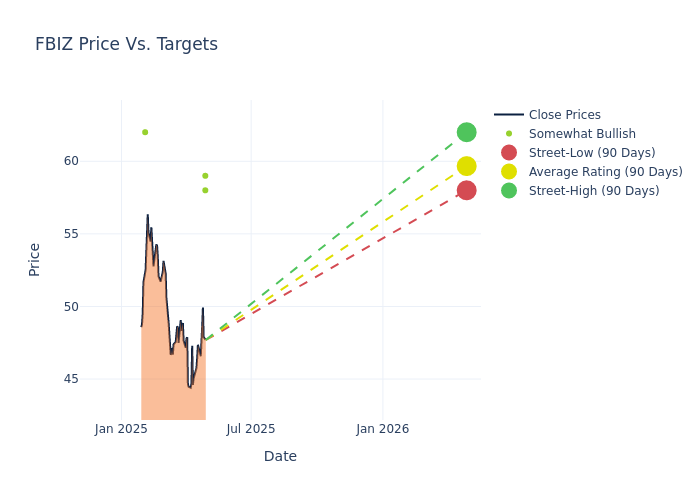

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $60.4, along with a high estimate of $63.00 and a low estimate of $58.00. This upward trend is evident, with the current average reflecting a 5.96% increase from the previous average price target of $57.00.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive First Business Finl Servs is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |——————–|———————–|—————|—————|——————–|——————–| |Nathan Race |Piper Sandler |Raises |Overweight | $58.00|$57.00 | |Damon Delmonte |Keefe, Bruyette & Woods|Lowers |Outperform | $59.00|$60.00 | |Nathan Race |Piper Sandler |Raises |Overweight | $63.00|$58.00 | |Damon Delmonte |Keefe, Bruyette & Woods|Raises |Outperform | $60.00|$58.00 | |Daniel Tamayo |Raymond James |Raises |Outperform | $62.00|$52.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they ‘Maintain’, ‘Raise’, or ‘Lower’ their stance, it signifies their reaction to recent developments related to First Business Finl Servs. This insight gives a snapshot of analysts’ perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from ‘Outperform’ to ‘Underperform’. These ratings convey the analysts’ expectations for the relative performance of First Business Finl Servs compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for First Business Finl Servs’s future value. Examining the current and prior targets offers insights into analysts’ evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of First Business Finl Servs’s market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on First Business Finl Servs analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About First Business Finl Servs

First Business Financial Services Inc operates as a bank holding company. The Bank operates as a business bank, delivering a full line of commercial banking products including commercial loans and commercial real estate loans, to meet the specific needs of small and medium-sized businesses, business owners, executives, professionals, and high-net-worth individuals. The company’s products and services include commercial lending, SBA lending and servicing, asset-based lending, equipment financing, factoring, trust, and investment services, treasury management services, and a broad range of deposit products. Geographically all the business activity functioned through the region of the United States.

A Deep Dive into First Business Finl Servs’s Financials

Market Capitalization: Surpassing industry standards, the company’s market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: First Business Finl Servs displayed positive results in 3M. As of 31 December, 2024, the company achieved a solid revenue growth rate of approximately 12.34%. This indicates a notable increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Financials sector.

Net Margin: First Business Finl Servs’s net margin excels beyond industry benchmarks, reaching 33.64%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): First Business Finl Servs’s ROE excels beyond industry benchmarks, reaching 4.49%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): First Business Finl Servs’s ROA excels beyond industry benchmarks, reaching 0.37%. This signifies efficient management of assets and strong financial health.

Debt Management: First Business Finl Servs’s debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.04, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.