In the preceding three months, 16 analysts have released ratings for PVH PVH, presenting a wide array of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 7 | 7 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 4 | 5 | 0 | 0 |

| 2M Ago | 2 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

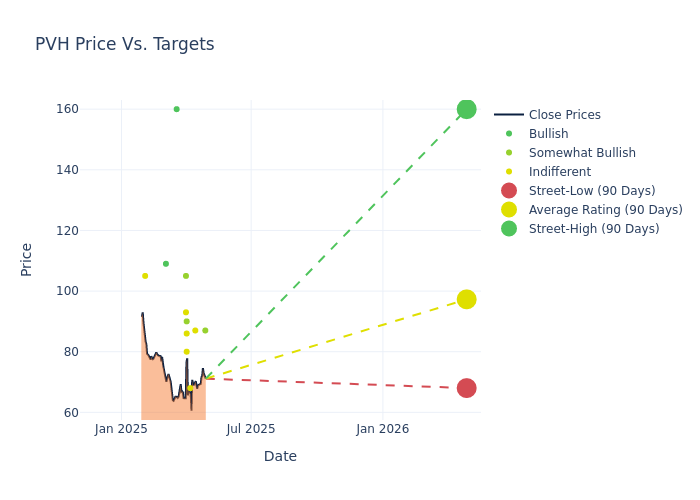

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $95.19, along with a high estimate of $160.00 and a low estimate of $68.00. This current average has decreased by 16.46% from the previous average price target of $113.94.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of PVH by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |——————–|———————|—————|—————|——————–|——————–| |Adrienne Yih |Barclays |Lowers |Overweight | $87.00|$103.00 | |Matthew Boss |JP Morgan |Lowers |Neutral | $87.00|$91.00 | |Paul Lejuez |Citigroup |Lowers |Neutral | $68.00|$83.00 | |Adrienne Yih |Barclays |Raises |Overweight | $103.00|$98.00 | |Kimberly Greenberger|Morgan Stanley |Lowers |Equal-Weight | $86.00|$95.00 | |Ashley Helgans |Jefferies |Lowers |Hold | $80.00|$101.00 | |Dana Telsey |Telsey Advisory Group|Maintains |Outperform | $90.00|$90.00 | |Simeon Siegel |BMO Capital |Lowers |Market Perform | $93.00|$106.00 | |Michael Binetti |Evercore ISI Group |Lowers |Outperform | $105.00|$139.00 | |Dana Telsey |Telsey Advisory Group|Maintains |Outperform | $90.00|$90.00 | |Paul Lejuez |Citigroup |Lowers |Neutral | $72.00|$123.00 | |Dana Telsey |Telsey Advisory Group|Lowers |Outperform | $90.00|$130.00 | |Jay Sole |UBS |Lowers |Buy | $160.00|$172.00 | |Brooke Roach |Goldman Sachs |Lowers |Buy | $109.00|$128.00 | |Adrienne Yih |Barclays |Lowers |Overweight | $98.00|$144.00 | |Ike Boruchow |Wells Fargo |Lowers |Equal-Weight | $105.00|$130.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they ‘Maintain’, ‘Raise’, or ‘Lower’ their stance, it signifies their response to recent developments related to PVH. This offers insight into analysts’ perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from ‘Outperform’ to ‘Underperform’. These ratings convey expectations for the relative performance of PVH compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of PVH’s stock. This comparison reveals trends in analysts’ expectations over time.

To gain a panoramic view of PVH’s market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on PVH analyst ratings.

Discovering PVH: A Closer Look

PVH designs and markets branded apparel in more than 40 countries. Its key fashion categories include men’s dress shirts, ties, sportswear, underwear, and jeans. Its two designer brands, Calvin Klein and Tommy Hilfiger, now generate practically all its revenue after its recent disposition of most of its smaller brands. PVH operates e-commerce sites, about 1,400 stores, and about 1,500 shop-in-shops and concessions. The firm also licenses its brands to third parties and distributes its merchandise through department stores and other wholesale accounts. PVH traces its history to 1881 and is based in New York City.

PVH: Financial Performance Dissected

Market Capitalization Analysis: Positioned below industry benchmarks, the company’s market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Negative Revenue Trend: Examining PVH’s financials over 3M reveals challenges. As of 31 January, 2025, the company experienced a decline of approximately -4.75% in revenue growth, reflecting a decrease in top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: PVH’s net margin is impressive, surpassing industry averages. With a net margin of 6.63%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): PVH’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 3.01% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company’s ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.41%, the company showcases effective utilization of assets.

Debt Management: PVH’s debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.66.

What Are Analyst Ratings?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish “analyst ratings” for stocks. Analysts typically rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.