Senior Wedbush Securities equity analyst Dan Ives doubles down on software amid the intensifying storm of trade and tariffs.

What Happened: On Thursday, Ives called software the only “safety blanket” in what he described as a “Category 5” storm, referring to the ongoing trade war, tariffs, and other geopolitical uncertainties, while appearing on CNBC’s “Squawk On The Street.”

Ives says that anything with a supply chain has its “visibility clouded” in this storm, leaving software as the safe bet, giving the example of Alphabet Inc. GOOG, Microsoft Corp. MSFT, and Palantir Technologies Inc. PLTR.

He also pushed back on rumors of a slowdown in AI data center demand and speculation that major hyperscalers are cutting their capital expenditure on AI infrastructure. He said he “strongly disagrees” with that narrative, though he acknowledged there may be some “reallocation on the edges.” According to Ives, “Hyperscale and big tech are ploughing ahead.”

“They realize that this is an arms race,” Ives says, adding that nobody wants to be left behind in this revolution, and it’s not what his findings “from the field” say.

Why It Matters: During its first quarter earnings on Thursday, Alphabet committed to $75 billion in AI capital spending this year, up from $52 billion last year, proving Ives’ point that there is no slowdown in AI data center demand.

Ives has also repeatedly stated that the “AI party is just getting started,” predicting over $1 trillion in incremental spending in the sector over the next decade.

Price Action: Shares of Alphabet were up on Thursday by 2.38%, and 4.63% in after-hours trading following the company’s first quarter earnings. Microsoft and Palantir were up by 3.45% and 6.90% during the day, respective.

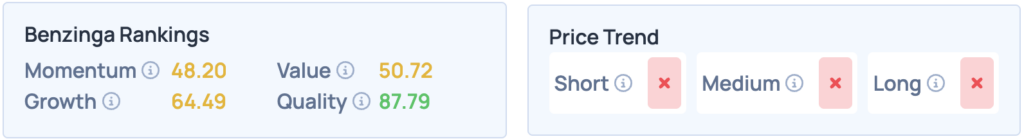

Shares of Alphabet don’t fare too well on Benzinga’s Edge Stock Rankings, but what about peers such as Microsoft, Amazon, and Facebook? Sign up to Benzinga Edge for more such insights.

Photo Courtesy: Zakharchuk on Shutterstock.com

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.