A new biography on Elon Musk sheds light on the billionaire entrepreneur’s Icarus moment. Hubris Maximus, by Washington Post technology reporter Faiz Siddiqui, uncovers “The Shattering of Elon Musk” across three distinct periods in recent years.

What Happened: On Wednesday, Siddiqui offered a brief glimpse of his upcoming book on Musk, discussing his opinions on CNBC’s “Squawk Box.”

Siddiqui says that his book depicts the Tesla Inc. TSLA CEO in three distinct phases, starting with the controversial “funding secured” tweet in 2018, which prompted a Securities and Exchange Commission investigation, followed by the COVID-19 era, and then the acquisition of Twitter, or as it’s now called, X.

The book describes a pattern that Siddiqui notices with Musk, which often involves a big event, such as the acquisition of Twitter, resulting in public backlash, followed by a quiet period, and then reinvention, with Musk moving on to something else.

According to Siddiqui, his book depicts several instances of individuals who “fiercely” and “devotedly” believed in Musk’s promises, and while they still support his goals, they were “disappointed in the man.”

Unlike Icarus, the author doesn’t believe that Musk has, or is going to, crash and burn. What’s “shattered” is essentially the “veneer on Elon,” Siddiqui says. “Elon was unimpeachably our Tony Stark,” he says, but he doesn’t think that’s true anymore, thanks to the tech mogul’s “Hubris,” or exaggerated pride.

Why It Matters: Recently, Musk’s behavior and mental health issues came under scrutiny when his biographer, Seth Abramson, voiced his fears.

Musk himself has acknowledged and defended his use of prescription Ketamine to treat occasional depressive episodes, adding that the drug has been beneficial for investors in his companies.

Back in 2017, when asked if he was bipolar by a user on Twitter, Musk replied, “Yeah,” before adding, “Maybe not medically [though].” Around the same time, he tweeted about experiencing “greater highs, terrible lows, and unrelenting stress,” hinting at bipolar disorder.

The reality is great highs, terrible lows and unrelenting stress. Don’t think people want to hear about the last two.

— Elon Musk (@elonmusk) July 30, 2017

Despite recent turbulence, many investors and analysts continue to express confidence in Elon Musk’s leadership and long-term vision.

On Wednesday, Tesla shares rallied after Musk announced he would scale back his involvement in the Department of Government Efficiency starting in May, a market reaction that came in spite of the company’s weak first-quarter results.

Analyst Dan Ives of Wedbush Securities raised his target for Tesla to $350, a 40% upside from current levels, merely on news of Musk’s return as a full-time CEO. This comes despite a range of challenges and headwinds now facing the EV giant. This “removes the black clouds over Tesla,” Ives said, as he will be “laser-focused” on Tesla again.

Price Action: Tesla shares rallied 5.37% on Wednesday, following the company’s much-anticipated first quarter earnings, which was released on Tuesday.

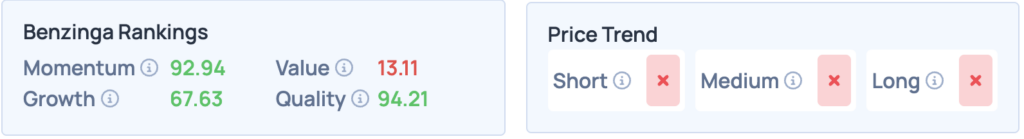

According to Benzinga Edge Stock Rankings, Tesla scores well across most metrics besides value. The price trend, however, remains unfavorable in the short, medium, and long term. For more such insights, sign up for Benzinga Edge today!

Photo Courtesy: Shutterstock.com

Read More: Tesla’s Energy Division Shines, But ETF Risks Mount Amid Broader Challenges

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.