Analysts’ ratings for Utz Brands UTZ over the last quarter vary from bullish to bearish, as provided by 5 analysts.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

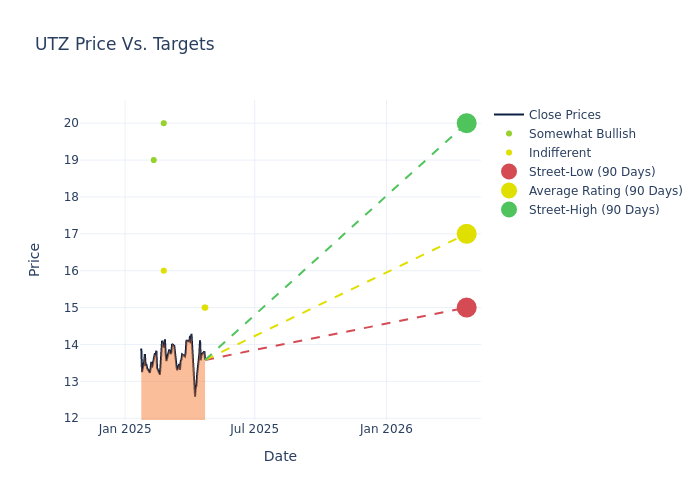

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $17.0, a high estimate of $20.00, and a low estimate of $15.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 13.92%.

Exploring Analyst Ratings: An In-Depth Overview

In examining recent analyst actions, we gain insights into how financial experts perceive Utz Brands. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating |Current Price Target| Prior Price Target | |——————–|——————–|—————|—————|——————–|——————–| |Peter Grom |UBS |Announces |Neutral | $15.00|- | |Robert Moskow |TD Cowen |Lowers |Hold | $15.00|$17.00 | |Nik Modi |RBC Capital |Lowers |Outperform | $20.00|$23.00 | |Brian Holland |DA Davidson |Lowers |Neutral | $16.00|$18.00 | |John Baumgartner |Mizuho |Lowers |Outperform | $19.00|$21.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they ‘Maintain’, ‘Raise’ or ‘Lower’ their stance, it reflects their response to recent developments related to Utz Brands. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from ‘Outperform’ to ‘Underperform’. These ratings reflect expectations for the relative performance of Utz Brands compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Utz Brands’s stock. This comparison reveals trends in analysts’ expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Utz Brands’s market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Utz Brands analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Utz Brands’s Background

Utz Brands Inc is a manufacturer of branded salty snacks. It produces a broad offering of salty snacks, including potato chips, tortilla chips, pretzels, cheese snacks, pork skins, pub/party mixes, and other snacks. Its iconic portfolio of authentic, craft, and better-for-you (BFY) brands, which includes Utz, Zapp’s, On The Border, Golden Flake, and Boulder Canyon, among others, enjoys household penetration in the United States, where its products can be found in approximately half of U.S. household. The company operates in eight manufacturing facilities with a broad range of capabilities, and its products are distributed nationally to grocery, mass, club, convenience, drug, e-commerce and other retailers through direct shipments, distributors, and approximately 2,500 DSD routes.

A Deep Dive into Utz Brands’s Financials

Market Capitalization Perspectives: The company’s market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Utz Brands’s revenue growth over a period of 3M has faced challenges. As of 31 December, 2024, the company experienced a revenue decline of approximately -3.14%. This indicates a decrease in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Utz Brands’s net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 0.68%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Utz Brands’s ROE surpasses industry standards, highlighting the company’s exceptional financial performance. With an impressive 0.33% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Utz Brands’s ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.09%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Utz Brands’s debt-to-equity ratio surpasses industry norms, standing at 1.34. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.