American Express Company AXP will release earnings results for the first quarter, before the opening bell on Thursday, April 17.

Analysts expect the New York-based company to report quarterly earnings at $3.47 per share, up from $3.33 per share in the year-ago period. American Express projects to report quarterly revenue at $16.93 billion, compared to $15.8 billion a year earlier, according to data from Benzinga Pro.

On March 25, CLEAR extended its partnership with American Express for its second one year renewal term.

American Express shares fell 1.9% to close at $252.92 on Wednesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

Let’s have a look at how Benzinga’s most-accurate analysts have rated the company in the recent period.

- JP Morgan analyst Richard Shane maintained a Neutral rating and cut the price target from $325 to $244 on April 8, 2025. This analyst has an accuracy rate of 67%.

- Citigroup analyst Keith Horowitz maintained a Neutral rating and slashed the price target from $320 to $300 on March 24, 2025. This analyst has an accuracy rate of 74%.

- Goldman Sachs analyst Ryan Nash maintained a Buy rating and slashed the price target from $367 to $330 on March 18, 2025. This analyst has an accuracy rate of 65%.

- Baird analyst David George upgraded the stock from Underperform to Neutral with a price target of $265 on March 14, 2025. This analyst has an accuracy rate of 71%.

- Wells Fargo analyst Donald Fandetti maintained an Overweight rating and increased the price target from $355 to $370 on Jan. 31, 2025. This analyst has an accuracy rate of 71%.

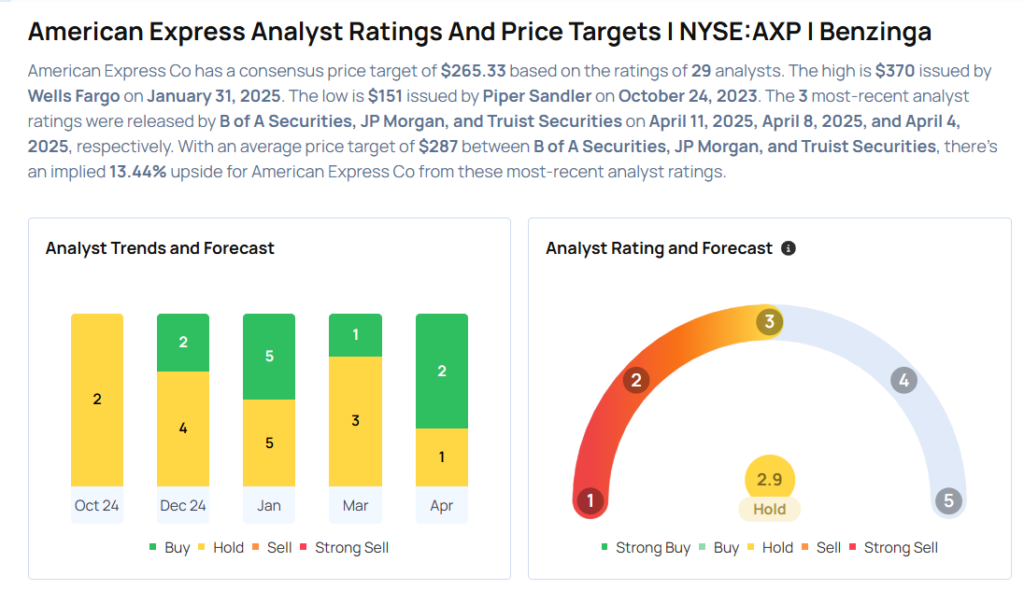

Considering buying AXP stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.