Across the recent three months, 9 analysts have shared their insights on Five9 FIVN, expressing a variety of opinions spanning from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 3 | 3 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

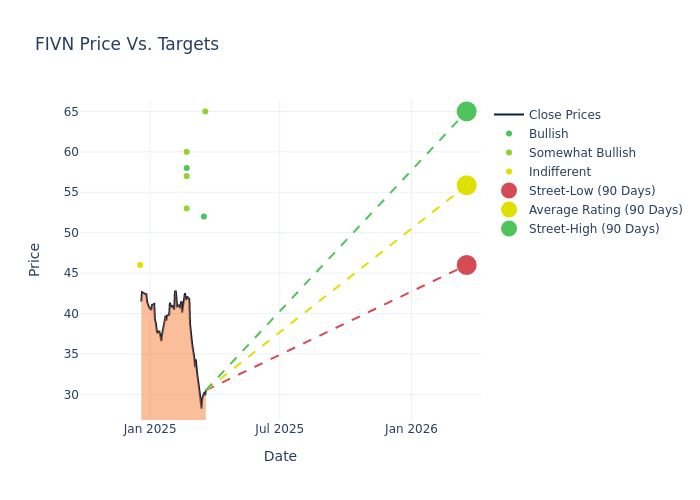

The 12-month price targets, analyzed by analysts, offer insights with an average target of $55.0, a high estimate of $65.00, and a low estimate of $46.00. This current average reflects an increase of 5.26% from the previous average price target of $52.25.

Exploring Analyst Ratings: An In-Depth Overview

In examining recent analyst actions, we gain insights into how financial experts perceive Five9. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rishi Jaluria | RBC Capital | Maintains | Outperform | $65.00 | $65.00 |

| Scott Berg | Needham | Maintains | Buy | $52.00 | $52.00 |

| Thomas Blakey | Cantor Fitzgerald | Raises | Overweight | $57.00 | $46.00 |

| James Fish | Piper Sandler | Raises | Overweight | $53.00 | $46.00 |

| Scott Berg | Needham | Maintains | Buy | $52.00 | $52.00 |

| Catharine Trebnick | Rosenblatt | Raises | Buy | $58.00 | $50.00 |

| Ryan Macwilliams | Barclays | Raises | Overweight | $60.00 | $55.00 |

| Scott Berg | Needham | Maintains | Buy | $52.00 | $52.00 |

| Thomas Blakey | Cantor Fitzgerald | Announces | Overweight | $46.00 | – |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they ‘Maintain’, ‘Raise’, or ‘Lower’ their stance, it signifies their response to recent developments related to Five9. This offers insight into analysts’ perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from ‘Outperform’ to ‘Underperform’. These ratings convey the analysts’ expectations for the relative performance of Five9 compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Five9’s future value. Comparing current and prior targets offers insights into analysts’ evolving expectations.

Capture valuable insights into Five9’s market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Five9 analyst ratings.

Discovering Five9: A Closer Look

Five9 offers cloud-native contact center software enabling digital customer service, sales, and marketing engagement. The company’s Virtual Contact Center platform combines core telephony functionality, omnichannel engagement, and various modules into a unified cloud contact-center-as-a-service, or CCaaS, platform. Five9’s modules include digital self-service, agent assist technology, workflow automation, as well as workforce optimization solutions that optimize call center efficiency, and manage interaction quality and agent performance.

Five9’s Economic Impact: An Analysis

Market Capitalization: Indicating a reduced size compared to industry averages, the company’s market capitalization poses unique challenges.

Revenue Growth: Five9’s revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2024, the company achieved a revenue growth rate of approximately 16.56%. This indicates a substantial increase in the company’s top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company’s net margin is a standout performer, exceeding industry averages. With an impressive net margin of 4.15%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Five9’s financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 1.95%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Five9’s ROA stands out, surpassing industry averages. With an impressive ROA of 0.57%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 1.98, Five9 faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish “analyst ratings” for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga’s automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.