Financial giants have made a conspicuous bullish move on Moderna. Our analysis of options history for Moderna MRNA revealed 31 unusual trades.

Delving into the details, we found 51% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 17 were puts, with a value of $1,290,308, and 14 were calls, valued at $844,212.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it’s evident that the major market movers are focusing on a price band between $20.0 and $145.0 for Moderna, spanning the last three months.

Analyzing Volume & Open Interest

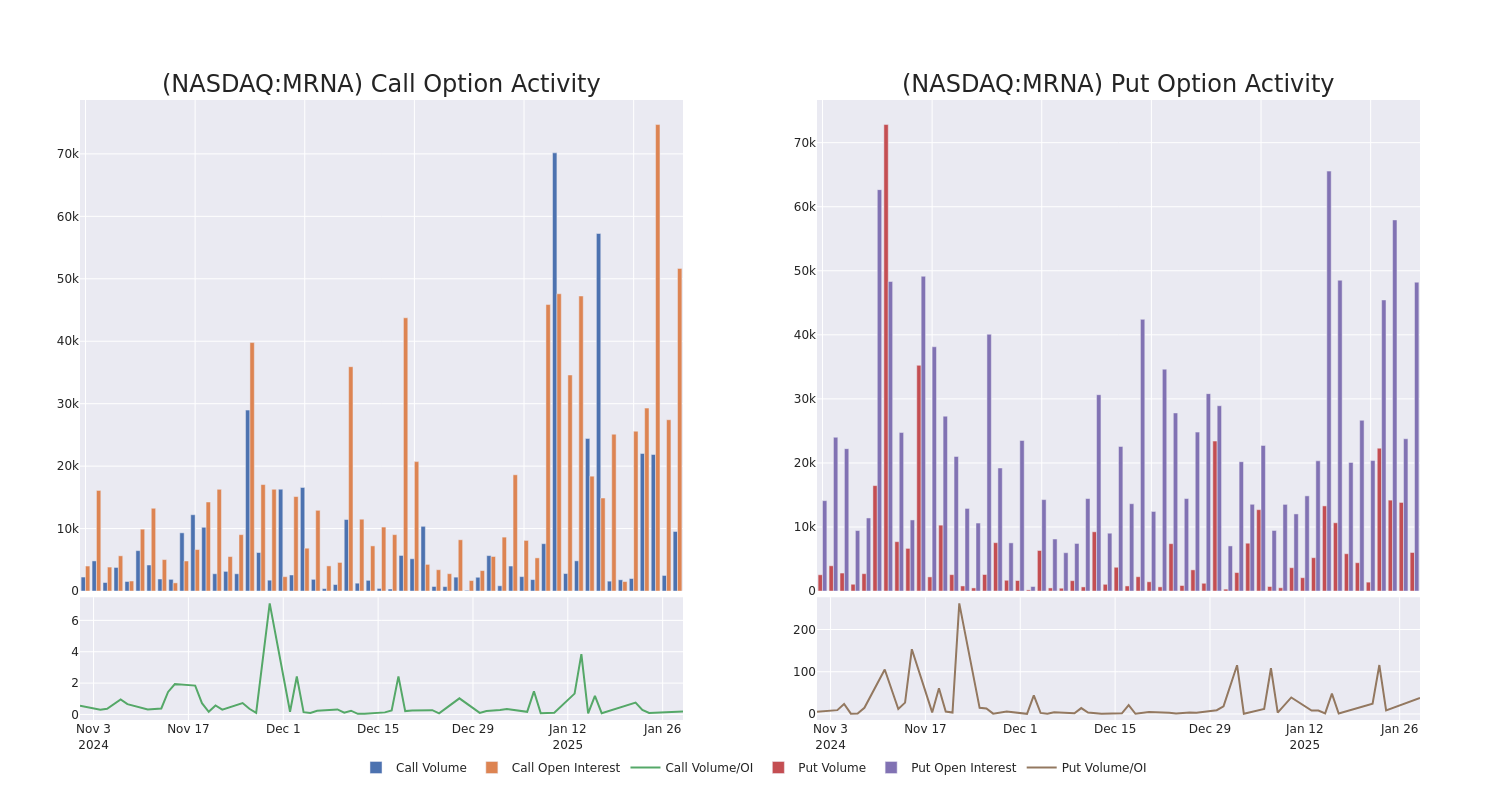

In today’s trading context, the average open interest for options of Moderna stands at 4343.04, with a total volume reaching 15,556.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Moderna, situated within the strike price corridor from $20.0 to $145.0, throughout the last 30 days.

Moderna Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRNA | PUT | TRADE | NEUTRAL | 01/16/26 | $4.4 | $4.1 | $4.25 | $30.00 | $467.5K | 4.9K | 1.1K |

| MRNA | PUT | SWEEP | BULLISH | 03/21/25 | $9.3 | $9.15 | $9.15 | $50.00 | $147.3K | 4.2K | 161 |

| MRNA | CALL | TRADE | BULLISH | 01/16/26 | $14.6 | $14.4 | $14.6 | $35.00 | $146.0K | 19.9K | 152 |

| MRNA | CALL | SWEEP | BULLISH | 02/14/25 | $3.5 | $3.4 | $3.5 | $44.00 | $140.3K | 87 | 2.3K |

| MRNA | CALL | SWEEP | BULLISH | 02/14/25 | $3.55 | $3.45 | $3.45 | $44.00 | $132.5K | 87 | 563 |

About Moderna

Moderna is a commercial-stage biotech that was founded in 2010 and had its initial public offering in December 2018. The firm’s mRNA technology was rapidly validated with its covid vaccine, which was authorized in the United States in December 2020. Moderna had 40 mRNA development candidates in clinical development as of September 2024. Programs span a wide range of therapeutic areas, including infectious disease, oncology, cardiovascular disease, and rare genetic diseases.

After a thorough review of the options trading surrounding Moderna, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Moderna’s Current Market Status

- Trading volume stands at 11,242,282, with MRNA’s price down by -3.65%, positioned at $43.3.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 16 days.

Professional Analyst Ratings for Moderna

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $66.8.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Moderna, which currently sits at a price target of $38. * An analyst from UBS has decided to maintain their Buy rating on Moderna, which currently sits at a price target of $96. * Consistent in their evaluation, an analyst from Goldman Sachs keeps a Buy rating on Moderna with a target price of $99. * In a cautious move, an analyst from Goldman Sachs downgraded its rating to Neutral, setting a price target of $51. * Maintaining their stance, an analyst from Evercore ISI Group continues to hold a In-Line rating for Moderna, targeting a price of $50.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for Moderna, Benzinga Pro gives you real-time options trades alerts.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.