Jeff Bezos-backed Perplexity reportedly bid to merge with TikTok U.S. on Saturday, but Wedbush analyst Dan Ives hinted Elon Musk’s X could ultimately seal the deal amid rising speculation.

What Happened: On Saturday, Perplexity submitted a bid to ByteDance, TikTok’s Chinese parent company, to form a new entity that includes Perplexity, TikTok U.S., and new capital partners, reported CNBC, citing sources familiar with the matter.

The proposed merger would allow most of ByteDance’s current investors to maintain their equity stakes while improving Perplexity’s video capabilities.

The source estimates the deal’s value to exceed $50 billion, contingent on ByteDance’s shareholders’ decisions to stay or cash out.

Perplexity, a startup challenging Alphabet Inc.‘s GOOG GOOGL Google, saw its valuation soar from $500 million to $9 billion last year.

Subscribe to the Benzinga Tech Trends newsletter to get all the latest tech developments delivered to your inbox.

Why It Matters: Previously, Tesla Inc. TSLA CEO Elon Musk was considered a potential buyer, though concerns were raised about the impact on the EV giant.

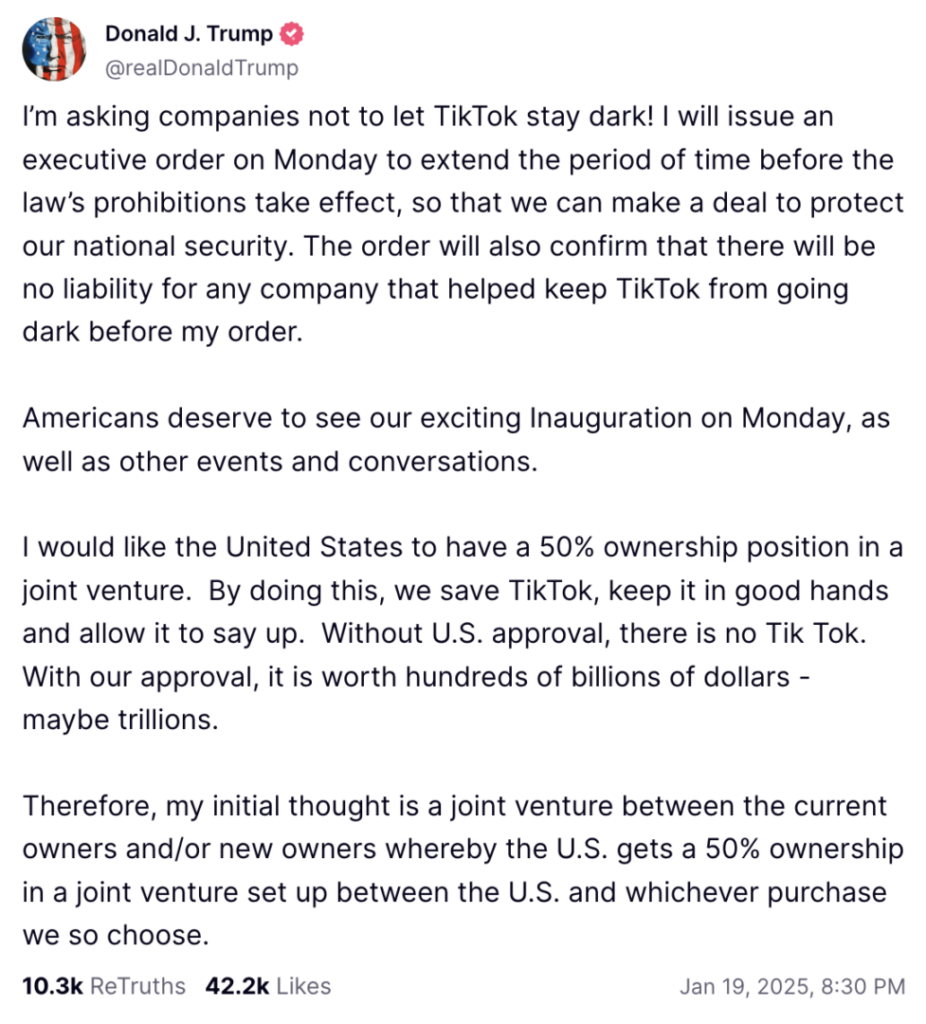

TikTok, which went dark for some time later Saturday started restorning its services on Sunday. Donald Trump “most likely” plans to extend TikTok’s deadline by 90 days to facilitate a deal.

Musk also took to X, formerly Twitter, and highlighted that while his social media app is not allowed to operate in China, banning TikTok in the U.S. would be “against freedom of speech.”

I have been against a TikTok ban for a long time, because it goes against freedom of speech.

That said, the current situation where TikTok is allowed to operate in America, but 𝕏 is not allowed to operate in China is unbalanced.

Something needs to change. https://t.co/YVu2hkZEVZ

— Elon Musk (@elonmusk) January 19, 2025

Before Trump’s statement about potentially extending TikTok’s deadline, Ives took to X and predicted that the 90-day window would be used to work on a deal with U.S. tech players, with Musk’s X being a likely candidate.

Biden Admin never issued the statement…so TikTok went dark for 170 mm users. We believe Trump turns it back on with an Executive Order on Monday once he is sworn in as US President. Then 90 days to work on buyer/partnership with US tech player likely being Musk/X in our view https://t.co/O2UdLOCMIO

— Dan Ives (@DivesTech) January 19, 2025

ByteDance has previously suggested it will not sell TikTok U.S.

Check out more of Benzinga’s Consumer Tech coverage by following this link.

Read Next:

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.

Market News and Data brought to you by Benzinga APIs

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.