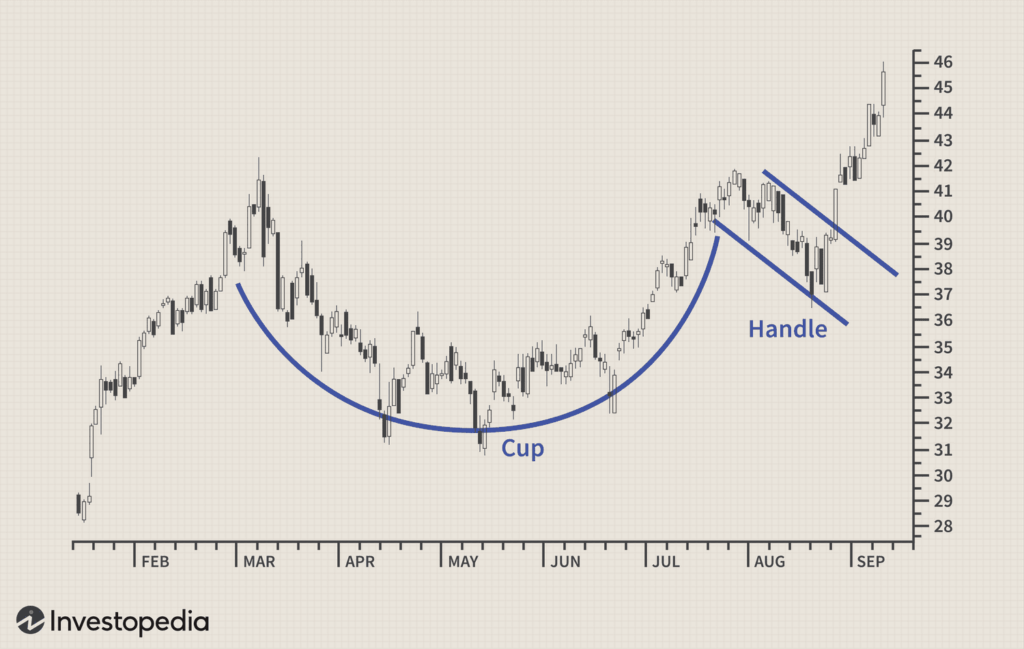

Power Nickel Inc. (TSXV: PNPN) (OTCBB: PNPNF), a prominent Canadian exploration company, has reached an impressive milestone by hitting a year-to-date high of $0.93 on the TSXV and $0.66 on the OTCBB. This significant price movement is drawing attention from investors and traders alike, as it appears to be part of a classic cup-and-handle breakout pattern. This technical formation is often indicative of a bullish continuation, signaling the potential for further upward momentum.

The Cup-and-Handle Breakout: A Bullish Signal

The cup-and-handle pattern forming in Power Nickel’s stock chart is a well-known technical indicator. The “cup” resembles a rounded bottom, showing a period of consolidation and accumulation, while the “handle” indicates a brief pullback before a breakout to higher levels. With Power Nickel’s shares now trading near their year-to-date highs, this breakout pattern could lead to increased trading volume and heightened investor interest in the days ahead.

This price movement aligns with a series of positive developments for the company, including its robust exploration progress and strategic corporate initiatives. As investors monitor the breakout pattern, attention is also turning to Power Nickel’s underlying fundamentals and the company’s recent announcements, which add further depth to its growth story.

Spin-Off Shares: Unlocking Hidden Value for Shareholders

A key factor contributing to investor enthusiasm is the company’s recent announcement of a plan of arrangement to spin out its Golden Ivan property and certain Chilean exploration assets into a new entity, Chilean Metals Inc. (“Spinco”). Shareholders of Power Nickel will be rewarded with shares in Spinco as part of this transaction. Specifically, shareholders of record will receive:

- One New Power Nickel Share for each existing share held.

- 0.05 Spinco Shares for each Power Nickel share held.

The spin-off, which has already received shareholder and court approval, is expected to become effective on January 31, 2025, subject to TSXV approval and other customary conditions. This initiative aims to unlock value by allowing Power Nickel to focus exclusively on its flagship Nisk Project, a high-grade nickel-copper-PGM polymetallic discovery, while Spinco advances the Golden Ivan property and Chilean assets.

The Golden Ivan property, located in British Columbia, comprises 13 mineral claims covering 797 hectares, while the Chilean assets include promising projects like Zulema, Tierra de Oro, and Palo Negro. By separating these assets, Power Nickel intends to maximize their respective potential, providing investors with exposure to two specialized companies.

Lion Zone: A Game-Changing Discovery

Another driving force behind Power Nickel’s recent success is its ongoing exploration at the Lion Zone within the Nisk Project. The Lion Zone has delivered a series of impressive assay results, showcasing its polymetallic potential. Recent highlights include intercepts of 32 meters at 7% CuEq and 40 meters at 4.19% CuEq, underscoring the deposit’s high-grade nature.

The company’s use of advanced exploration techniques, such as downhole EM and geophysical surveys, has enhanced its ability to delineate the mineralized zone and expand its footprint. With a 30,000-meter drill program underway, Power Nickel continues to push the boundaries of the Lion Zone’s potential. As CEO Terry Lynch stated, “We are learning more about the mineralized zone and how it behaves, and our ability to track and anticipate the zone is improving.”

What’s Next for Power Nickel?

The year 2024 has been transformational for Power Nickel, marked by strategic milestones, robust exploration results, and corporate initiatives that position the company for long-term growth. As the market watches the development of the cup-and-handle breakout pattern, the focus remains on several key catalysts:

- Completion of the Spin-Off: The arrangement’s effective date and the distribution of Spinco shares are pivotal events that could drive further investor interest.

- Continued Exploration Success: Results from the ongoing drill program at the Lion Zone and other targets within the Nisk Project will be critical in maintaining momentum.

- Market Reaction to Technical Patterns: As the stock approaches its breakout levels, technical traders will likely continue to pile in, fueling volatility and potential upside.

Power Nickel’s combination of strong technical indicators, strategic corporate moves, and exciting exploration potential makes it a stock to watch as it heads into 2025. With its shares already at year-to-date highs and poised for more action, investors should keep a close eye on this emerging nickel powerhouse.

*Disclaimer

InvestingToday.co is a financial information website that provides news, analysis, and marketing services related to publicly traded companies. By using this website, you agree to the terms and conditions outlined in this Disclaimer.

Disclosure in Accordance with Toronto Stock Exchange Rules

This publication has been compensated by Power Nickel and other companies to disseminate information. We adhere to the disclosure rules set forth by the Toronto Stock Exchange (TSX) and other regulatory bodies, ensuring that all compensated content is clearly labeled and disclosed to our readers.

Forward-Looking Statements

This website includes forward-looking statements about future anticipated plans, performance, and development of the companies we cover. Any statements on this website that are not statements of historical fact should be considered forward-looking statements. These statements generally can be identified by words such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” “intends,” and similar expressions. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements.

Educational and Informational Purposes Only; Not Investment Advice

All content on InvestingToday.co, including articles, posts, newsletters, and comments, is provided for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or relied upon as personalized investment advice. InvestingToday.co recommends you consult a licensed or registered professional before making any investment decision, as investments can be fully lost at any time.

No Guarantees

InvestingToday.co offers no guarantees and provides forward-looking statements with the sole purpose of personal enjoyment and entertainment. If at any time a security discussed on InvestingToday.co is purchased, you agree to hold InvestingToday.co harmless and liability-free. There are no guarantees in participating in financial markets, and investments can be lost entirely at any time.

No Investment Advisor or Registered Broker

Neither InvestingToday.co nor any of its owners or employees are registered as a securities broker-dealer, investment advisor (IA), or IA representative with any securities regulatory authority. InvestingToday.co does not give out investment advice, and all content is intended solely for informational and educational purposes.

Risks and Warnings

The content published on this website is intended for reference purposes only and is neither an offer nor a solicitation to purchase or sell any security or instrument or to participate in any particular trading strategy. Users of this website agree that they are not using any content of this website in connection with an investment decision. Persons should consult with their financial advisors before making any investment decisions.

OTC Risk Warnings:

Because many securities traded Over-The-Counter (OTC) are relatively illiquid, an investment in an OTC security involves a high degree of risk. It should be noted that the liquidation of a position in an OTC security may not be possible within a reasonable period of time. Dependable information regarding issuers of OTC securities may not be available, making it difficult to properly value an investment.

Consent

By using this website and its services, or by providing us with information about yourself, you consent to the collection, storage, and use of this information. If you do not agree to these terms, please exit the website now.

Safe Harbor Statement

Forward-looking statements on this website are subject to risks and uncertainties that could cause actual results to differ materially. The Publisher does not guarantee the accuracy of any forward-looking statements and assumes no responsibility for any such statements.

Compensation Disclosure

Power Nickel has engaged InvestingToday.co for an Investor Awareness and Marketing Service Agreement through the balance of 2024. We are compensated $150,000 USD to create content for use in social media campaigns and actively support the company’s messages in financial forums across the Internet. The full press release regarding this engagement can be found here.

From time to time, InvestingToday.co provides information about publicly traded companies that have retained our services for advertising, branding, marketing, analytics, and news distribution. Compensation may create an actual or potential conflict of interest, which should be considered by all readers. Please be aware that we may buy or sell securities of the companies mentioned on this website at any time, creating a potential conflict of interest.