5 Stocks on a Wall Street Trader’s Watchlist for the Last Week of 2025

As 2025 winds down, the market buzz continues to focus on standout performers and high-potential stocks poised for more gains in the coming year. Here’s a look at five stocks dominating Wall Street traders’ watchlists.

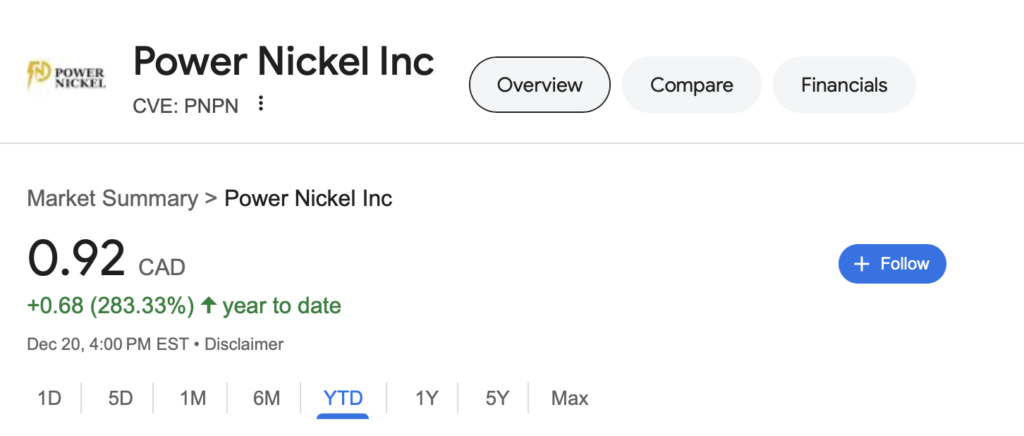

1. Power Nickel 🇨🇦 PNPN 🇺🇸 $PNPNF

Power Nickel has been a juggernaut in the mining sector, skyrocketing nearly 300% in 2024. This momentum carries into 2025, fueled by record-breaking drill results in October and a fresh 52-week high on the chart.

Geopolitical factors could also play a significant role in Power Nickel’s trajectory. Recent tensions between the Trump administration and the Canadian government have highlighted the critical nature of resource independence, potentially rekindling confidence in the mining industry. However, Canada’s current policies around foreign investments and regulatory hurdles have left some investors cautious.

What sets Power Nickel apart is its solid management team, which has consistently executed on its strategy, positioning the company as a leader in the space. While mining stocks are notoriously volatile, much like biotech stocks, Power Nickel’s upside volatility has caught traders’ attention. With strong fundamentals and positive trends, this is a stock to watch as we head into 2025.

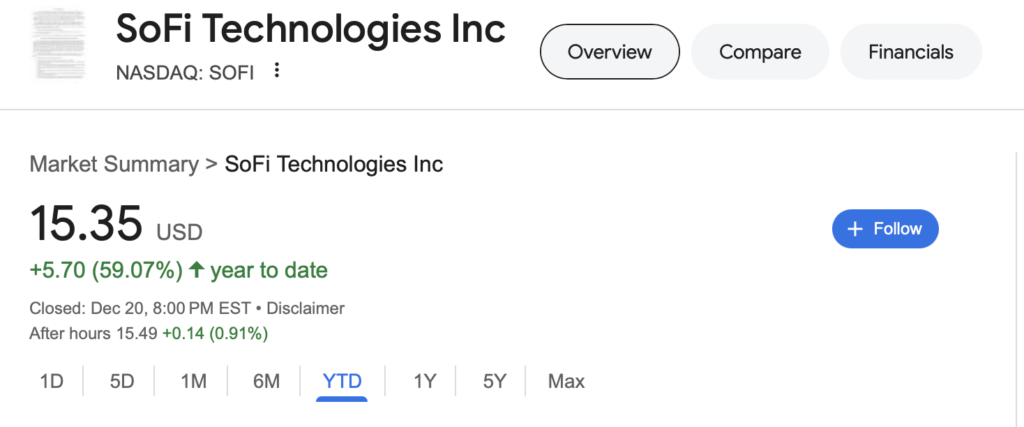

2. SOFI Technologies (SOFI)

SOFI Technologies captured headlines with a huge short squeeze in 2024, driving its stock price from $6 to $17. The company’s partnership with the Chargers and Rams, as sponsors during a potential playoff run, is creating a surge in brand visibility.

Moreover, SOFI’s position in crypto-friendly banking gives it an edge in attracting new customers in a rapidly evolving financial landscape. As 2025 approaches, SOFI shows no signs of slowing down, and traders are keeping a close eye on this fintech leader for its next move.

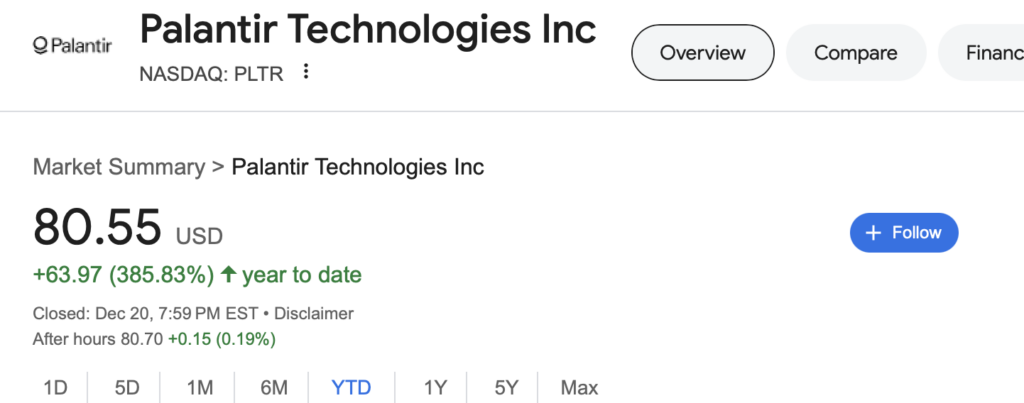

3. Palantir Technologies (PLTR)

Palantir is up a staggering 385% year-to-date, making it one of the year’s top performers. With geopolitical tensionson the rise, the demand for Palantir’s cutting-edge data analytics and AI-driven solutions has never been higher.

Many are speculating whether Palantir could hit the $100 mark in 2025. However, after such a monumental rally, traders must be cautious of potential pullbacks. Palantir remains a stock worth monitoring for its ability to navigate global uncertainty and deliver significant upside.

4. Robinhood (HOOD)

Robinhood continues to dominate the crypto space, thanks to its user-friendly platform that makes buying and selling digital assets accessible to the masses. Despite its strong position, Robinhood holds less than 10% of the coins that competitor Coinbase has available, highlighting enormous growth potential in 2025.

As crypto adoption grows, Robinhood’s simplicity and expanding offerings make it a prime candidate for continued success. Traders are watching for the company to leverage its market position to capture additional share in the burgeoning crypto economy.

5. Nvidia (NVDA)

Despite being up significantly, Nvidia remains a powerhouse worth tracking. The Trump administration’s focus on bolstering USA-made chips will likely amplify Nvidia’s opportunities in the semiconductor space.

With the largest market share and unmatched capital resources, Nvidia is poised to continue leading in AI and chip innovation. While the stock has had a strong run, the broader political and technological landscape suggests there’s still room for Nvidia to climb higher in 2025.

Final Thoughts

These five stocks represent a mix of momentum, innovation, and geopolitical tailwinds, making them prime candidates for traders heading into the final week of 2025. From Power Nickel’s mining dominance to Nvidia’s chip leadership, these companies have the potential to drive significant gains into the new year. However, as with any investment, traders must balance opportunity with risk, especially for stocks that have already experienced substantial runs.

Which of these stocks are you watching as we close out the year?

*Disclaimer

InvestingToday.co is a financial information website that provides news, analysis, and marketing services related to publicly traded companies. By using this website, you agree to the terms and conditions outlined in this Disclaimer.

Disclosure in Accordance with Toronto Stock Exchange Rules

This publication has been compensated by Power Nickel and other companies to disseminate information. We adhere to the disclosure rules set forth by the Toronto Stock Exchange (TSX) and other regulatory bodies, ensuring that all compensated content is clearly labeled and disclosed to our readers.

Forward-Looking Statements

This website includes forward-looking statements about future anticipated plans, performance, and development of the companies we cover. Any statements on this website that are not statements of historical fact should be considered forward-looking statements. These statements generally can be identified by words such as “believes,” “expects,” “anticipates,” “foresees,” “forecasts,” “estimates,” “intends,” and similar expressions. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements.

Educational and Informational Purposes Only; Not Investment Advice

All content on InvestingToday.co, including articles, posts, newsletters, and comments, is provided for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or relied upon as personalized investment advice. InvestingToday.co recommends you consult a licensed or registered professional before making any investment decision, as investments can be fully lost at any time.

No Guarantees

InvestingToday.co offers no guarantees and provides forward-looking statements with the sole purpose of personal enjoyment and entertainment. If at any time a security discussed on InvestingToday.co is purchased, you agree to hold InvestingToday.co harmless and liability-free. There are no guarantees in participating in financial markets, and investments can be lost entirely at any time.

No Investment Advisor or Registered Broker

Neither InvestingToday.co nor any of its owners or employees are registered as a securities broker-dealer, investment advisor (IA), or IA representative with any securities regulatory authority. InvestingToday.co does not give out investment advice, and all content is intended solely for informational and educational purposes.

Risks and Warnings

The content published on this website is intended for reference purposes only and is neither an offer nor a solicitation to purchase or sell any security or instrument or to participate in any particular trading strategy. Users of this website agree that they are not using any content of this website in connection with an investment decision. Persons should consult with their financial advisors before making any investment decisions.

OTC Risk Warnings:

Because many securities traded Over-The-Counter (OTC) are relatively illiquid, an investment in an OTC security involves a high degree of risk. It should be noted that the liquidation of a position in an OTC security may not be possible within a reasonable period of time. Dependable information regarding issuers of OTC securities may not be available, making it difficult to properly value an investment.

Consent

By using this website and its services, or by providing us with information about yourself, you consent to the collection, storage, and use of this information. If you do not agree to these terms, please exit the website now.

Safe Harbor Statement

Forward-looking statements on this website are subject to risks and uncertainties that could cause actual results to differ materially. The Publisher does not guarantee the accuracy of any forward-looking statements and assumes no responsibility for any such statements.

Compensation Disclosure

Power Nickel has engaged InvestingToday.co for an Investor Awareness and Marketing Service Agreement through the balance of 2024. We are compensated $150,000 USD to create content for use in social media campaigns and actively support the company’s messages in financial forums across the Internet. The full press release regarding this engagement can be found here.

From time to time, InvestingToday.co provides information about publicly traded companies that have retained our services for advertising, branding, marketing, analytics, and news distribution. Compensation may create an actual or potential conflict of interest, which should be considered by all readers. Please be aware that we may buy or sell securities of the companies mentioned on this website at any time, creating a potential conflict of interest.